|

|

|

|

|

| |

|

Vol. 11 - Issue 2

February 28, 2022

|

|

|

|

|

|

| |

Jackie Robinson is a major historical figure. But even the most rabid football fans probably do not know who broke the NFL color barrier.

For USA Today, I interviewed former #1 overall draft pick, 3-time Pro-Bowler and ESPN host Keyshawn Johnson, about his recent book that looks at the NFL’s history of racism and the four Black players who finally broke the color barrier in 1946.

I hope you can check it out:

https://www.coverageopinions.info/NFLIntegration.pdf

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

The Coverage Opinions Interview With Maureen Clark: From Olympic Curler To Corporate Lawyer

|

|

|

| |

The Olympics just wrapped up. So we had our quadrennial dose of curling -- watching players sweeping ice with a broom.

To get the story on this peculiar-looking sport, I spoke to Maureen Brunt Clark – a member of the U.S. Olympic curling team, at the Turin Olympics in 2006, and now a corporate lawyer in Minneapolis.

“It just doesn’t look that difficult. I could do it,” I said to Maureen. She’s heard that before.

I hope you can check out my interview, for the ABA Journal website, with this Olympian-turned-lawyer.

https://www.abajournal.com/columns/article/olympic-curler-slides-to-corporate-lawyer

|

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

"Work From Home” Dispute Leads To Lawsuit Between Spouses

|

|

|

|

|

| |

I was in IKEA last week and grabbed a pizza for dinner in the restaurant. The waiter brought a ball of dough, a bowl of sauce and some cheese on a plate. I looked at him with a really curious expression. “Oh , sorry,” he said. “I forget to give you this.” He handed me one of those little wrenches.

***

With “work from home” having taken over corporate America, disputes and bickering between spouses are surely at an all-time high. And given the litigiousness in which we are accustomed, it is not surprising that one of those disputes ended up in court. And, coincidentally, it arose out of an IKEA incident.

Right at the start of the pandemic, Joan and Bill Rogers, an accountant and management consultant, respectively, in Des Moines, Iowa, realized that they would be working from home. They rushed to order a desk from IKEA. It arrived and Billy, who fancied himself as a “pretty handy guy” -- for proof, he pointed to pictures that he had successfully hung in his house -- went to work putting it together.

An hour later, Billy, with a look of satisfaction on his face, declared the project finished. Joan studied the desk and asked why there was a board still laying in the box. “It was an extra piece,” Billy replied. “IKEA must have put it in, just in case one was broken.” Joan looked at her husband of 27 years with an expression of breathtaking disbelief. “IKEA does not include extra parts,” she said, incredulously. “You obviously didn’t follow the directions if you have an extra board.”

Billy, now on the defensive, pushed down hard on every aspect of the desk and opened and closed the drawers. “It seems to be working just fine,” he said, smugly. “Would you like me to say ‘it’s working just fine’ in Swedish?”

Two weeks later, while Joan was on a Zoom call, the desk collapsed. Thankfully, she had been on mute, so her seven colleagues did not hear the crash.

Billy rushed into the room and witnessed what had happened. Joan looked at Billy and replied “jag sa det.”

Billy, curious, ran to the internet and typed the strange words into a translator site. Jag sa det, he learned, meant “I told you so” in Swedish.

Billy was incensed. Four years earlier, following a dispute over how to use the television remote control, the couple had entered into a consent decree, which barred each from saying “I told you so” to the other -- “even if a reasonable spouse would agree that it was the greatest example ever of an ‘I told you so’ situation.”

Billy filed suit in Iowa District Court, in Polk County, asserting breach of the consent decree. Joan filed a motion to dismiss, arguing that the consent decree was not violated as it barred the use of “I told you so,” clearly an English phrase, and did not bar the phrase from being said in a foreign language.

The judge heard oral argument on the motion on February 15 and took it under advisement.

The suit had drawn local media interest and a reporter from the Des Moines Register caught up with the couple outside the courthouse. She asked them how they could stay married if one filed a lawsuit against the other.”

“Oh, we love each other very much,” Billy replied. “But we both hate being wrong.” Joan agreed and the couple walked hand-in-hand to their car.

|

| |

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Encore: Randy Spencer’s Open Mic

When Insurance Coverage Stinks

|

|

|

|

|

| |

This “Open Mic” column originally appeared in the April 1, 2014 issue of Coverage Opinions. |

| |

Last week a California federal court held that no coverage was owed to Mixt Greens, a restaurant located in San Francisco, for damages that it allegedly caused to a neighboring restaurant, Murphy’s Deli. Murphy’s beef -- the offensive odor of Mixt Greens’s cooking oil was passing through the ventilation system and into Murphy’s. Travelers Prop. & Cas. Co. v. Mixt Greens, Inc., No. 13-957 (N.D. Cal. Mar. 25, 2014).

[Talk about the pot calling the kettle black. While I love the smell of a deli, not everyone compares the combined odor of corned beef and herring to the aroma of the fragrance counter at Nordstrom. In one of my all-time favorite coverage cases, in 2010, a federal court in New York made a judicial pronouncement about deli smells. The court held in Greengrass v. Lumbermans Mut. Cas. Co. that the pollution exclusion did not apply to odors emanating from the “King of Sturgeon’s” delicatessen. In support of its decision the court noted that, according to Zagat’s restaurant guide, “[t]he smells alone are worth the price of admission.” The Second Circuit affirmed.]

Back to Mixt Greens, where the court held that the odors emitted from the ducts into Murphy’s Deli should not be deemed a “loss of use of tangible property.” “Here, the Underlying Action does not involve any potential liability for damages on account of ‘property damage’ as that term is defined in the Mixt Greens policy. The only damages Cal–Murphy seeks from Mixt Greens in the Underlying Action are for economic losses. The fact that Cal–Murphy does not seek to recover the cost of repairing or replacing any tangible property, and that no part of its restaurant was ever closed because of the odors—not even for an hour—compels the conclusion that Cal–Murphy’s losses, which are purely economic, are not covered under the policy and Travelers is not obligated to defend Mixt Greens or Hines/NOP in the Underlying Action.” Mixt Greens got tossed.

Seeing the Mixt Greens decision immediately made me think of the granddaddy of all odor coverage cases: the 11th Circuit’s 2011 decision in Maxine Furs, Inc. v. Auto-Owners Insurance Company.

In Maxine Furs, the court held that the aroma of Indian food was a pollutant within the terms of a pollution exclusion. Despite its best effort to curry favor with the court, the policyholder was shown the tandoori. It is a decision that the policyholder will no doubt describe as papa-dumb. Of course, the insurer knew all along that the policyholder was going to vindallose. Let’s tikka look at why.

Maxine Furs is a fur shop located next door to an Indian restaurant. Because the two establishments shared air-conditioning ducts, Maxine’s furs soon began to smell like curry. Maxine had the affected furs cleaned and then made a claim with Auto-Owners Insurance Company. Auto-Owners denied coverage based on the absolute pollution exclusion clause in Maxine’s policy. Maxine sued. The district court concluded that coverage was excluded.

The parties disagreed whether curry aroma was a pollutant. The court looked to the policy’s definition of pollutant, in conjunction with the applicable standard for interpreting a policy, and concluded that it did “not think that a person of ordinary intelligence could reasonably conclude that curry aroma is not a contaminant under these circumstances.”

The court explained: “A contaminant is something that “soil[s], stain[s], corrupt[s], or infect[s] by contact or association.” Webster’s Third New International Dictionary 491 (1986). Indeed, what happened here is that the curry aroma soiled Maxine’s furs. Otherwise, they would not have needed cleaning. We do not think that a reasonable person could conclude otherwise. Accordingly, we conclude that curry aroma is a pollutant under the policy.” Lastly, the court concluded that the “wafting” of the curry aroma satisfied the “migrating, seeping, or escaping” requirement of the pollution exclusion.

Mumbai for now. See you next issue.

|

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Rodney Dangerfield Goes Back To (Law) School

|

|

|

| |

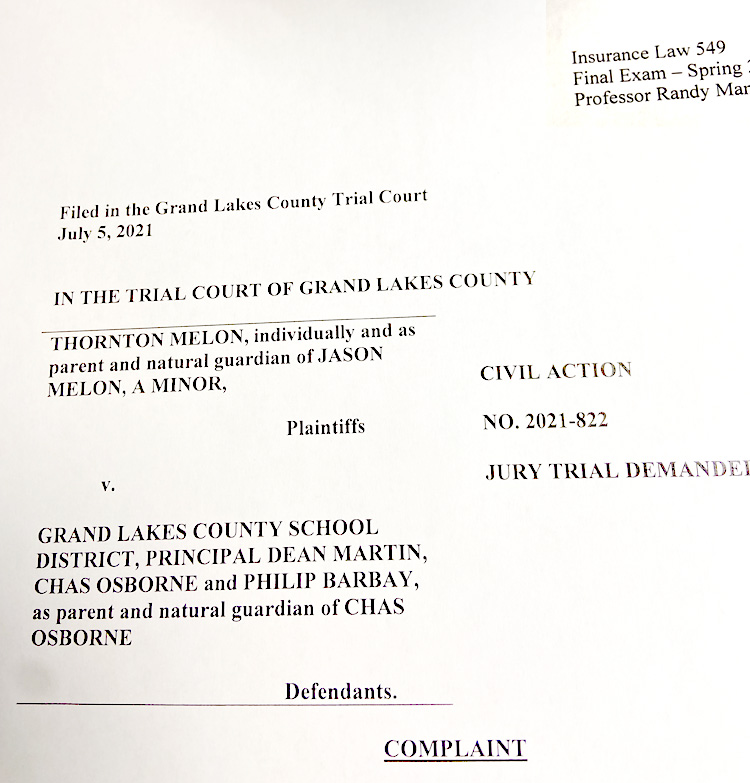

To commemorate what would have been Rodney Dangerfield’s 100th birthday on November 22, 2021, all of the individuals in the fact pattern, in my Insurance Law final exam, were characters from his classic movie – “Back To School.”

[By the way, here’s an article that I did in November, for USA Today, that paid tribute to Rodney on his centennial birthday: https://www.coverageopinions.info/USATodayDangerfieldFinal.pdf]

I always through it was goofy when law professors tried to be funny or clever with the names of the individuals used in the fact patterns of their exams. It might have been funny to them…

So what have I done with my final exam characters since becoming an adjunct professor at Temple Law School four years ago? Take one guess. It must be something in the water.

Welcome to the Fall 2021 Insurance Law 549 final exam:

|

| |

| |

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Stephen Johnson Speaks To My Temple Law School Students

|

|

|

| |

Thank you to Stephen Johnson, long-time property-casualty expert witness, who Zoomed in, from Atlanta, to my Insurance Law class late last semester. Stephen spoke to the students about bad faith failure to settle and the seminal Stowers case from Texas.

As a former chief claims executive, with decades in the P&C industry, including providing sound claims practices for his staff, Stephen was able to provide significant insight into this high-stakes issue. While outside counsel can offer much on this issue, Stephen brought a unique C-suite perspective. His presentation was very well-received by the students.

I told Stephen that it was the only class all semester where all 23 students were present. He was flattered. Shhh. Don’t tell him – the final exam review was scheduled for after his presentation.

Thank you to Stephen for sharing his unique insight into this challenging issue.

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

The Absolute Worst Possible Time For An Insurer To Commit Bad Faith Claims Handling

|

|

|

| |

Needless to say, it is always an unfortunate situation when an insurer commits bad faith claims handling. But some cases may be worse than others. If an insurer is going to commit bad faith, it would be a wise idea not to tangle with this insured.

|

| |

|

Nilson v. Peerless Indem. Ins. Co., 484 F. Supp. 3d 1050 (D.N.M. 2020).

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

A Rarity: Spectator Can Pursue A Claim For Getting Hit By A Foul Ball

|

|

|

| |

Regular readers of Coverage Opinions know that I have a soft spot for cases where spectators, hit by a foul ball, seek recovery from stadium operators for their injuries. The outcomes of these disputes are fairly predicable: the injured spectator goes home empty handed.

This is on account of the so-called “baseball rule,” an assumption of the risk doctrine adopted by the great majority of courts nationally that have confronted this issue. This rule limits the duty owed by baseball stadium operators to spectators injured by foul balls. It generally provides that a stadium operator is not liable for a foul ball injury so long as it screens the most dangerous part of the stadium and provides screened seats to as many spectators as may reasonably be expected to request them.

In late January, the California Court of Appeal issued a published opinion, in Mayes v. La Sierra University, holding that a spectator could pursue a claim for serious injuries sustained when struck by a foul ball at a college baseball game.

The trial court dismissed the suit, calling it a “textbook primary assumption of the risk case.” The appellate court reversed.

Why did Monica Mayes succeed – at least for the moment – when so many other injured spectators, from sea to shining sea, have not?

It was all about the facts. This was not your typical case when the injured fan was sitting twenty rows up, behind third base, in a typical stadium setting. Instead, Mayes, attending a college game (where her son was pitching), was seated in a “grassy area along the third-base line, behind the dugout, which extended eight feet above the ground. and there was no protective netting above the dugout.”

In addition, it was a playoff game (hundreds in attendance) and there were very few seats behind protective fencing (two temporary bleachers to accommodate 20 people each). There were also distractions for Mayes, as people were “‘walk[ing] around freely’ in the area where Mayes was sitting, and people had also erected tents and umbrellas in the area. The tents, umbrellas, and nonstationary people were generally causing distractions and blocking Mayes's view of the playing field.”

Of note, Mayes had attended 300 to 400 baseball games in which her two sons had played.

It is a lengthy decision with a discussion of numerous “baseball rule” cases. In summary, the court ruled that Mayes could get to a jury for the following reasons:

“Mayes showed there were triable issues of fact concerning the scope of La Sierra’s duty of care to spectators at its baseball games, and whether La Sierra breached its duty of care to Mayes. All of the evidence adduced on the motion showed there are triable issues of fact concerning whether La Sierra had a duty of care, or breached its duty of care, in failing to (1) install protective netting over and beyond its dugouts; (2) warn spectators that there was no protective netting over its dugouts; (3) provide a greater number of screened seats at its April 22, 2018 game, or at its playoff games, and (4) exercise crowd control, in order to remove distractions and reduce the risk that spectators who sat in the unscreened areas along the first- and third-base lines would be hit by balls leaving the field of play. Reasonable jurors could reach differing conclusions on these duty and breach-of-duty questions.”

In its final analysis, Mayes v. La Sierra College goes against significant precedent nationally on the spectator-injury issue. So, despite its unique facts, courts going forward – in California and elsewhere -- are sure to be pointed to it by others seeking to recover for a foul ball mishap.

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Supreme Court Justice Nominee, Judge Ketanji Brown Jackson, And Insurance Coverage: What Could Have Been

|

|

|

| |

As you are reading this, Senate staffers, journalists, bloggers and the like are scrutinizing Judge Ketanji Brown Jackson’s hundreds of opinions, as a judge on the U.S. District Court for the District of Columbia and D.C. Circuit Court, in search of information that could support or derail her confirmation as a SCOTUS justice. We all know how the process works.

It is a safe bet that none of these sleuths will give more than a few seconds attention to Markel American Ins. Co. v. Metcor, Ltd., No. 14-1899 (D.D.C. Jan. 31, 2019). It is the only opinion of the judge’s that I could locate addressing coverage for a property-casualty claim. That there was only one came as no surprise. The D.C. District Court and D.C. Circuit Court are pretty much barren wastelands when it comes to property-casualty coverage cases.

Even worse than there being just a single case, Metcor was nothing more than a very brief opinion, adopting the recommendation of a magistrate judge, concerning personal jurisdiction and a motion for a default judgment. Deadly dull procedural stuff with nothing to do with coverage.

But it gets even worse still. The claim at the center of the dispute involved an 80-foot sailboat that had been damaged by either a manufacturer’s defect or -- get this -- a whale collision. Markel maintained that both were excluded under the policy. No court, as far as I can tell, has ever addressed a whale collision as a covered cause of loss or exclusion under an insurance policy. Although, I suspect that some coverage firms claim to have a very busy Whale Insurance Coverage practice group -- handling collision claims involving all manner of species of whales.

[The whale collision claim itself, which was separate from the personal jurisdiction and a motion for a default judgment, was settled.]

So, basically, Judge Ketanji Brown Jackson, who may spend decades on the nation’s highest court, addressing the most important cases and fundamental issues and rights, could have achieved another huge milestone -- first ever judge to weigh in on insurance coverage for a whale collision.

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Contest Winner: Insurance Coverage New Year’s Resolutions

|

|

|

| |

Congratulations to Wayne McAmis, Claims Senior Quality Advisor with PEMCO Mutual Insurance Company in Seattle, on winning the Insurance Coverage New Year’s Resolutions contest.

Wayne resolves not to be deposed in 2022. What a great entry!

I’ll be sending Wayne an autographed copy of John Grisham’s latest book – The Judge’s List.

Congratulation to Wayne and thank you to all who entered.

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Hassett Glasser Attorneys Publish 50-State Guide On Insurance Producers’ Duty to Advise

|

|

|

| |

As someone who has spent about 14 years researching and writing 50-state surveys of various coverage issues, I have an appreciation for anyone who takes that task one.

So I am happy to offer my congratulations to Myles P. Hassett, Jamie A. Glasser and David R. Seidman, of Hassett Glasser in Phoenix, on the publication of their recent updated “Insurer Producers’ Duty to Advise: A Nationwide Guide To The Law Governing Insurance Producers' Obligations to Advise Their Customers.”

Rightly or wrongly, when an insured is denied coverage, a finger is sometimes pointed in the direction of a broker or agent for failing to secure coverage. At the heart of this issue is the broker’s or agent’s duty to have advised its client on matters of coverage.

The attorneys from Hassett Glasser have created the go-to resource for addressing this issue.

From Google Books:

“In this newly updated nationwide survey of the law on insurance producers' duty to advise their customers, the authors analyze applicable standards of care and associated liability trends in each of the United States, and in the District of Columbia. Over 30 new decisions have been included since the original survey conducted in 2010, impacting the law in more than half the states. This book summarizes the results of the survey and provides a detailed analysis of the authorities in each jurisdiction in a color-coded, state-by-state appendix.”

To order this valuable resource, visit the firm’s website https://www.hassettglasser.com/duty-to-advise

|

| |

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

You Gotta See This:

The Craziest, Strangest, Most Unexplainable Sweatshirt I’ve Ever Seen

|

|

|

| |

I was looking for a certain law book on Amazon and this incredibly odd item showed up in the search results.

Who in the world would think of this idea for a sweatshirt (even I wouldn’t). And who would buy something like this (even I wouldn’t).

Plus, I wouldn’t give insurance advice for tacos. Necco Wafers, yes. Twizzlers, probably. But definitely not tacos.

|

| |

|

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Meet The Insurance Key Issues Spokes-Dog

|

|

|

| |

When my dog, Gracie, heard that Legolas, Zurich’s Carrie Von Hoff’’s cat, was the official spokes-cat for Insurance Key Issues, she went barking-mad.

“This is what I get,” she said bitterly, “for allowing you to rub my belly, feed me snacks, kiss my face and take pictures of every one of my cute poses. I do all that for you and there’s a spoke-cat!? What am I, chopped liver-flavored cat food?”

So, of course, I apologized and told my beloved Gracie (born on the Caribbean island of Anguilla, interestingly) that she could be the Insurance Key Issues spokes-dog. She accepted, begrudgingly. She warned me that, because she was so hurt, she could not put her full effort into the job. If you want a spokes-animal who really cares, she said, “talk to Legolas.”

Meet Gracie -- the Insurance Key Issues spokes-dog

|

| |

|

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

At Last: Texas Supreme Court Answers The “Four Corners” Question

Decision Summarized By The Lone Star State’s Go-To Coverage Lawyers

|

|

|

| |

For years, there has been debate in Texas whether, or to what extent, extrinsic evidence can be used to determine if an insurer has a duty to defend. To put it another way – is the determination of an insurer’s duty to defend limited to the four corners of the complaint? Countless decisions have addressed this issue. An answer to the question was in desperate need from the state’s Supreme Court.

At long last it arrived earlier this month in the much-awaited decision in Monroe Guaranty Insurance Co. v. BITCO General Insurance Co. And the high court wasted no time applying it and providing further guidance. It did so in Pharr-San Juan-Alamo Independent School District v. Texas Political Subdivisions Property/Casualty Joint Self Insurance Fund, a decision handed down the same day.

When it comes to practicing Texas insurance coverage law, the lawyers at Shidlofsky Law, in Austin, are some of the best in the business [on the policyholder side]. It would be Coverage Opinions malpractice for me to report on these recent decisions without using their detailed summary, and, most importantly – analysis. It can be found here:

http://www.shidlofskylaw.com/blogs/blog28.html

|

| |

|

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Really, Really Strange Decision: Supreme Court Addresses Pollution Exclusion For The First Time

|

|

|

| |

Given how well-developed the law is nationally concerning the interpretation of the absolute/total pollution exclusion, it is unusual these days to see a state high court address the issue for the first time. But that’s what the Supreme Court of Mississippi did in Omega Protein v. Evanston Insurance Company, No. 2020-1097 (Miss. January 20, 2022). It is a really, really strange decision.

At issue was additional insured coverage for Omega Protein, for death and serious injuries, on account of an explosion, at one of its facilities, while employees of a subcontractor were performing welding work on a large metal storage tank used for the temporary storage of stickwater.

Of course, you know stickwater -- a byproduct of the fish meal and fish oil production process.

In addition to some additional insured issues, the Mississippi high court addressed the applicability of the pollution exclusion -- which an excess insurer asserted applied to preclude coverage.

The pollution exclusion at issue was pretty standard stuff, applying to “the actual, alleged or threatened discharge, dispersal, release, migration, escape, or seepage of pollutants,” with pollutants defined as “any solid, liquid, gaseous, or thermal irritant or contaminant including smoke, vapor, soot, fumes, acids, alkalis, chemicals, and waste. Waste includes material, to be recycled, reconditioned, reclaimed or disposed of.”

It was alleged that the explosion took place because stickwater produces gases from methanethiol, hydrogen sulfide and methane, all of which are extremely flammable and produced by the decomposition of organic matter. The opinion went on provide information about the toxicity and serious consequences of exposure to such substances.

The court concluded that the pollution exclusion did not apply as the terms “irritant” and “contaminant,” as used in the pollution exclusion, are subject to more than one meaning: “On one hand a substance can be an irritant or contaminant at its core and by its very nature. That substance is an irritant or a contaminant no matter where it is, how it is contained, or whether it is in contact with something actively irritating or contaminating it. On the other hand, pursuant to the above-cited definitions, a substance is not necessarily an irritant or contaminant until it comes into contact with something and is actively irritating or contaminating it.”

To give an example of this dual meaning of the terms “irritant” and “contaminant,” the court turned to crude oil: “Though it is contained inside [a] tanker, were it to come into contact with the water or wildlife, it would contaminate them immediately.” But, “[i]t can also be said that the same crude oil under the same set of facts is not a contaminant because it is located inside an inert container within the ship and is not in contact with anything. In that context, that crude oil it is not a contaminant because it is not actively contaminating something.”

Having concluded that the pollution exclusion is susceptible to more than one reasonable interpretation, the court concluded that it is ambiguous, must be construed in favor of coverage, so, therefore, it did not apply. That was it. End of story. No further discussion nor an application of this analysis to the facts at hand was provided.

The opinion reads like the court was in a 7-Mississippi rush to be done.

Of note, scores of Mississippi federal courts have addressed the pollution exclusion and concluded that it precluded coverage for all manner of hazardous substances, such as paint and glue fumes, Chinese drywall, ammonia, hydrochloric acid and more. The Omega Protein court did not mention a single one of these federal court decisions. Not that it needed to. But still. That was a lot of law to not even give a slight nod to.

I’m struggling with this decision.

There are no shortage of courts nationally that have concluded that the pollution exclusion does not apply to certain substances. But that’s usually because the court concludes that, despite the breadth of the pollution exclusion, and its otherwise applicability on its face, the exclusion must be limited to so-called traditional environmental pollution, based on its purported historical purpose. Or, some courts have concluded that the pollution exclusion, because so broadly worded, if applied literally, would have no limiting principle. But, in both cases, courts still conclude that the exclusion can apply to some substances -- just not every substance.

Here, is the Omega Protein court saying that the pollution exclusion cannot apply to any substance -- including a traditional pollutant, such as crude oil, as used in its example -- because “irritant” and “contaminant,” as words generally, are subject to two meanings?

Or, does Omega Protein require you to look at the particular substance and determine whether it is not an “irritant” and “contaminant” when safely stored, but can cause injury when outside of its container. Therefore, “irritant” and “contaminant” are subject to two meanings, in that particular case. Thus, the pollution exclusion does not apply to that substance? But aren’t most hazardous substances not hazardous when safely stored?

|

| |

|

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Court Addresses An Unusual Aspect Of The “What Is A ‘Claim’” Question

|

|

|

| |

Courts often address whether something qualifies as a “claim” in the context of considering whether coverage is owed. The issue usually arises with a “claims made” policy and whether a demand made against an insured, or an insured’s knowledge of a situation, is a “claim.” This can be for purposes of determining if a “claim” has been made against an insured during a certain policy period or whether an obligation to give notice to an insurer has arisen.

The “what is a ‘claim’” question arose in Roadway Services v. Travelers Cas. & Sur. Co., No. 20-2777 (N.D. Ohio Jan. 6, 2022) -- but not the way I just described it. Here, an employee of Roadway Services was killed, when struck by an automobile, while working on a repaving project. The widow of the decedent filed suit against Roadway, alleging an intentional tort. In other words, she was making an effort to circumvent the state’s worker’s compensation bar.

Roadway sought coverage under a multi-part policy issued by Travelers. One of the three coverage parts was applicable – Travelers “will pay on behalf of [...] the Insured Organization, Loss for Wrongful Acts, resulting from any Claim first made during the Policy Period.” The policy defined a “Claim” as including “1. a written demand [...] for monetary damages or non-monetary relief” or “2. a civil proceeding commenced by service of a complaint or similar pleading.”

At issue was the applicability of the following policy exclusion: “The Company will not be liable for Loss for any Claim for any bodily injury, sickness, disease, death, loss of consortium, emotional distress, mental anguish, humiliation, loss of reputation, libel, slander, oral or written publication of defamatory or disparaging material, or invasion of privacy.”

Of note, this exclusion contained as exception, stating that it will not apply to “any ‘Claim’ for emotional distress, mental anguish, or humiliation with respect to any employment related Wrongful Act.”

It was not disputed that the case involved an employment related Wrongful Act.

Travelers argued that no coverage was owed on account of the aforementioned exclusion for bodily injury, death, etc. and there was no “claim” for emotional distress or mental anguish to trigger the exception.

Roadway, however, argued that the exception applied -- as the widow alleged, in her request for relief, that she suffered mental anguish and sorrow.

But, as Travelers saw it, this was not a “claim” for mental anguish and sorrow, as there was no cause of action asserted for it. Rather, mental anguish was only alleged by the widow as part of her damages.

The court concluded that a “claim,” as defined under the policy, had been made for mental anguish: “The first definition squarely applies here. By including a request for damages associated with mental anguish in her complaint, Ms. Soto has made ‘a written demand [...] for monetary damages’ related to her mental anguish.”

“While it is true,” the court observed, “that the word claim often means cause of action, that is not the definition that Travelers has included in the D&O Policy.”

The court was also persuaded by the language of the exclusion, which applied to any Claim for any bodily injury, sickness, disease, humiliation, etc. “Those Claims are not causes of action,” the court observed. “A plaintiff cannot assert a cause of action for sickness or disease, for example. Therefore, Travelers’ proposed definition of Claim as being a cause of action does not make sense in the context of the contract.”

|

| |

|

|

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

Reminder: Reservation Of Rights Letter Must Be Sent To All Insureds

|

|

|

| |

I have often talked about this sometimes-overlooked issue: the need for an insurer to send a reservation of rights letter (or disclaimer) to all insureds being defended. In other words, not simply sending the ROR letter to the named insured, but, also, say the insured’s employees who were named in the suit and also being defended. There is case law holding that, if an ROR is not sent to all insureds, there is no ROR in effect for the insureds to whom it was not sent – even if it was sent to other insureds, including the named insured.

The insurer did not run afoul of this requirement in Country Mutual Insurance Company v. Jackson, No. 20-150 (E.D. Wash. Jan. 20, 2022). But it was argued by the insured that it had. At issue was whether a reservation of rights letter, based on the pollution exclusion, had been sent to all insureds. The court concluded that it had been. However, the court’s explanation, of why the insurer had complied with this obligation, provides a lesson in how an insurer could fail to do so:

“Country Mutual argues that its reservation of rights was adequate because the October 15, 2018 letter was properly addressed to the named insured, Inland Northwest Equipment Auction, Inc., in the ‘care of’ Thomas Reinland and that all relevant parties were notified of its contents. . . .

“The Court finds that Country Mutual did not waive its right to assert defenses to coverage on the underlying claims. First, it is evident that the October 15, 2018 letter was properly addressed to its insured, Inland Northwest Equipment Auction, Inc. Country Mutual expressly agreed to provide a defense subject to a reservation of rights to it ‘along with related individuals and entities named as defendants’ in the relevant lawsuits, which includes the Reinland Defendants. The Reinlands’ argument would have more merit if Thomas Reinland, Kunya Reinland, Ashly Reinland, and Reinland Properties, LLC individually tendered claims; however, they tendered one claim to Country Mutual through their shared attorney. And crucially, there is no dispute that the Reinlands received actual notice of Country Mutual’s agreement to provide a defense subject to a reservation of rights.”

|

| |

|

|

|

|

Vol. 11 - Issue 2

February 28, 2022

You Do Not Have The Right To Remain Silent

|

|

|

| |

No. v. Link, No. 2020AP1244 (Ct. App. Wis. Feb. 1, 2022) addresses the once-in-a-while seen issue of whether an insured can excuse its refusal to cooperate in a coverage investigation by asserting its Fifth Amendment right against self-incrimination. This usually arises when the insured’s claim, based on its civil liability, is also the subject of criminal or possible criminal proceedings. Here, Jay Link sought liability coverage for a claim that he had posted sexually inappropriate photographs on Facebook. In subsequent coverage litigation, the insurer served discovery requests on Link that he refused to respond to, instead invoking his Fifth Amendment right against self-incrimination.

The Wisconsin Court of Appeals affirmed the trial court’s decision that Link forfeited coverage on account of his failure to cooperate. In essence, the court held that constitutional immunity has no application to a private examination arising out of a contractual relationship. “[T]he threat or possibility of parallel criminal charges,” the court concluded, “did not relieve Link of his contractual duties under the policy.”

The court rejected Link’s argument that he was in a “Catch-22”: “Link argues, any admission of fault in the coverage dispute would have harmed his defense in the underlying lawsuit and may have represented a breach of other policy provisions requiring his cooperation with merits/liability counsel. This argument ignores the fact that Link himself demanded defense and indemnification under his policy. Having invoked the policy, Link was required to abide by its terms, including that he cooperate with coverage counsel and truthfully represent all material facts in the coverage dispute. Link does not explain why fulfilling these duties in the coverage cross-claim would have interfered with his defense on the merits or breached his duty of cooperation with respect to merits/liability counsel. And, as Midwest notes, if Link believed that fulfilling these duties ultimately would have harmed his defense, he could have foregone a defense paid for by his insurer.”

|

| |

|

|

|

|

|

|

| |

|

|

New York Appellate Division Holds That Pollution Exclusions Bar Coverage For PFAS Claims

My colleagues at White and Williams discuss last month’s decision, in Tonoga, Incorporated v. New Hampshire Insurance Company, where the New York Appellate Division held that the “sudden and accidental” pollution exclusion and “absolute” pollution exclusion relieved two insurers of a duty to defend an insured-manufacturer in connection with claims alleging damages as a result of exposure to PFAS.

Court Addresses Whether Pizza Sauce Is Trade Dress?

At issue in Amco Insurance Co. v. Ledo’s Inc., No. 21C2972 (N.D. Ill. Feb. 4, 2022) was coverage for Ledo’s, Inc. for a suit captioned Ledo Pizza System, Inc. v. Ledo’s, Inc., pending in the Norther District of Illinois. Based on that caption, you know right where this is going.

Ledo Pizza System, Inc. is a franchisor of pizza restaurants with over 100 locations and the owner of all kinds of Ledo-trademarks, not to mention having a secret sauce, proprietary ingredients and selling rectangular pizza. Ledo’s, Inc., having no connection whatsoever to Ledo Pizza System, Inc., operates a pizza restaurant. What could they have possibly been thinking?

Ledo’s, Inc. was sued. The case was obviously based on trademark infringement, which was not covered under its CGL policy. In an effort to get coverage, Ledo’s argued that the suit alleged infringement of trade dress, which does fall within the definition of “personal and advertising injury.”

The court was not convinced: “Merely indicating that Ledo Pizza® has achieved a particular image and product quality does not amount to a claim that Ledo’s, Inc. has in some identifiable way infringed upon the ‘total image and overall appearance’ that would make up the trade dress for Ledo Pizza® or the related franchises (as opposed to infringement of Ledo Pizza® mark itself). Even grafting onto the complaint the additional allegations Ledo’s, Inc. relies on from the heavily redacted settlement letter, such as Ledo System’s and Ledo Carryouts’ proprietary rights in a particular Ledo Pizza® ‘sauce, [] cheese, thin crust,’ and presentation, the Court discerns no trade dress claim—in other words, the Court finds no allegation that Ledo’s, Inc. has appropriated those traits so as to cause conceivable customer confusion.”

|

| |

|

|

|

| |

| |

| |

| |

| |

|

|

|

|

|

|

|

|

|