|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

|

|

|

|

|

|

| |

"You have to be able to say 'no,'" Fred Fielding tells me. He's referring to one of the requirements to be an effective counsel to the President of the United States. Fielding knows of what he speaks. He served as White House counsel to Presidents Ronald Reagan and George W. Bush.

I'm sitting across from Fred Fielding, in his corner office at Morgan Lewis in Washington, D.C., listening to him describe a job that only a handful of lawyers have ever experienced. It takes a lot of strength to be able to tell the most powerful man in the world things he may not want to hear. Yet Fielding is so soft-spoken that I have to pull my chair closer to his desk to hear him. I'm staring at my two tape recorders in front of him, praying that at least one is picking up what he's saying. When Fred Fielding speaks you must listen very attentively.

Over the course of an hour the very likeable and good-humored Fielding, 79, shared with me the job of White House counsel and some of his experiences. Bush had a button on his phone that said “Fielding.” The President started his day by pushing it. “Once I realized that I got in early,” Fielding says with a laugh.

|

|

|

|

| |

Fielding was in the White House the day that President Reagan was nearly assassinated. In the harried aftermath, Secretary of State Alexander Haig famously told a national television audience that he was in control. It was Fielding who afterward would tell Haig – no, you’re not.

Fielding served as deputy counsel to John Dean, President Nixon’s White House counsel during Watergate. Some believed that Fielding was so-called “Deep Throat” – the secret source for The Washington Post’s Bob Woodward and Carl Bernstein in their reporting that brought to light the scandal.

I posed an important question to Fielding about the Reagan White House: the protocol for eating from the jelly bean jar on the President’s desk in the Oval Office. I bet that Woodward fella never investigated that. But it wasn’t all fun and games. Fielding served as a Commissioner on the 9-11 Commission.

A Time magazine piece described Fred Fielding as “the ultimate Washington lawyer-insider.” The Wall Street Journal, New York Times and Los Angeles Times have said similarly. When Fred Fielding speaks, people listen very attentively.

|

| |

George H.W. Bush And A Fish Story

I arrived in Washington early for my meeting with Fred Fielding. President George H.W. Bush was lying in repose in the U.S. Capitol and I wanted to pay my respects. Bush had been Vice-President during Fielding's five-plus years in the Reagan White House. My first question for Fielding was more a request – a favorite Bush 41 story. He didn't have to think long.

Bush was an avid fisherman. In his first summer after being elected he went fishing at his home in Kennebunkport, Maine. It was reported that, day after day, the President wasn't catching anything. Finally, on the last day, he caught a blue fish. Fielding had been on a fishing trip of his own in Florida and caught a tarpon. Fielding sent Bush a note: "Dear Mr. President, What were you using for bait?" Bush sent a note back: "Dear Fred, thank you for your note. For bait I was using a very small tarpon, like the one you have in your picture.” |

|

|

|

| |

The Four Cent Stamp That Led To A Career

Fielding, a native Philadelphian, graduated from Gettysburg College in 1961 and headed off to the University of Virginia Law School. His reason for pursuing a course of legal studies was one shared by many: “I couldn’t decide what I wanted to do.” Securing a needed scholarship, Fielding chose Virginia, from among similar schools, because “you actually got money back to buy your books. It tipped the deal.”

Fielding didn’t dislike law school after the first year, he explained, but wasn’t enamored by it either. He decided that he would go back only if he made the law review. “I was down [in Long Beach Island, New Jersey] tending bar and waiting on tables and lifeguarding . . . and I got the letter. So I went back and I loved law school the last two years. But I really loved practicing law. It’s so much different than the academic side.”

From UVA, Fielding went to Morgan Lewis in Philadelphia. It was a short stay. After a year he was called to active duty in the Army where he spent two years in the Office of Security at the National Security Agency and left as a captain. He returned to Morgan Lewis. In 1970 the call came from the Nixon White House.

Watergate and Deep Throat

Fielding, at 31, went to work for White House counsel John Dean. Remarkably, Dean was just a year older and had come to the job from the Justice Department. How could the President’s top lawyer have so little experience? Fielding can only speculate: “The first counsel to President Nixon was John Ehrlichman. Ehrlichman then decided he was going to be the domestic counsel. . . . All of his lawyers and all his staff people plus others became the domestic counsel so they had to appoint somebody to be counsel to the President. . . . I can only surmise Ehrlichman didn’t want any real heavy competition.”

Dean pleaded guilty to obstruction of justice for his role in Watergate. Fielding’s proximity, to all that was going on, led some to believe that he was “Deep Throat.” Indeed, the speculation was serious. The Wikipedia page on the subject devotes more words to Fielding than any other candidate. “What started that was Haldeman,” Fielding explains. [H.R. Haldeman -- Nixon’s Chief of Staff.] “He wrote a book and in it he named me as his candidate to be Deep Throat.” Fielding finds the whole affair strange, telling me that he could demonstrate, at the time of certain critical meetings between Woodward and Bernstein and Deep Throat, that he was not in Washington. “But after a while it just got silly because people don’t listen.”

Adding to the speculation was a four-year project, undertaken by a University of Illinois journalism professor and his students, that concluded, in 2003, that Fielding was Woodward and Bernstein’s source. Speaking of the professor, “he tried to woo me first. ‘You’re a great American. We should award you.’ And I just wouldn’t respond. It drove him nuts. It drove him nuts.” [In 2005, Mark Felt, former Associate Director of the FBI, came out as Deep Throat. It was confirmed by Woodward.]

Fielding was unaware of the Watergate activities going on around him. But what if he had been. Could he have stopped it? “Let me put it this way,” Fielding tells me. “I know there are things that I prevented from happening and I am sorry that Watergate happened. Now whether I could have stopped it, I don’t know. I don’t know.”

There is no class in law school to prepare a lawyer to serve as White House counsel. But that’s not to say Fielding didn’t bring an education to the job. Hardly. His experience in Nixon’s counsel’s office, during one of the nation’s greatest scandals, served him well for things to come. “I would say I don’t recommend it,” Fielding says, chuckling. “But it’s the best training.”

White House Counsel

Fielding left the Nixon White House in 1974 and returned to Morgan Lewis, now its Washington office. In 1981 he went to work as White House counsel for President Reagan at the start of his administration. Fielding held the position for over five years before returning to private practice -- adding his name to Washington’s Wiley, Rein & Fielding. Twenty years later Fielding would reprise his role as White House counsel, serving a two year stint for President George W. Bush.

White House counsel is not an official government position. It is one of several assistants that the President is entitled to have, such a press secretary or chief of staff. Without a statutory description, Fielding explains, “each president defines it.”

Fielding worked on Reagan’s transition team but didn’t know him well. “The first serious conversation I ever had with him was when he asked me to be counsel to the President.” Describing his relationship with Reagan, “you had access but you had a very powerful Chief of Staff [James Baker] and it was a staff system.” “Then the confidence with the President and me grew. By the time I left I had been the only remaining original assistant to the President and so we had a very nice rapport.” Bush had a different management style, Fielding recounts. “He had me going to every meeting in the world.”

Certain aspects of the White House counsel job are fixed, such as addressing executive privilege, pardons, ethics compliance (the President has several roles that cannot mix), judicial selection, clearance of executive branch officials (“You have to have a nice conversation to see what the FBI may have missed.”), arbiter of disputes between department and agency general counsels, gifts to the President, political versus non-political travel and first family issues.

But in addition to these anticipated functions, Fielding explains, “there is this category of ‘other’ and the other you don’t know what it is.” The job calls for “expect[ing] the unexpected, because you never know what’s coming in when you walk in that day.” “It is a Lithuanian seaman jumping off and asking for asylum in the middle of the Atlantic Ocean.” At its core, as Fielding describes the job, it calls for “marshal[ling] the forces of the government and the tools of the government to deal with problems.” At one time he described the it as a legal air traffic controller. But then Reagan fired the air traffic controllers.

Fielding contrasts the job of White House counsel to working in private practice: “You’re a lawyer, you know, if you get a legal problem, you look at it, you mull it over, you talk to people, you do a little research, consult with other people, you give a tentative and then a final conclusion to the client. . . . Here, something happens you have to make a decision. There are no books to turn to -- how to be a counsel to the President. You make your decision and then you watch it on television that night. And you may not recognize the story because it’s somebody’s interpretation. So that’s something you have to get accustomed to. But you have to do it instantly. You have to have the judgment to understand and assimilate what the issue is and deal with it right away, unlike you and me in our daily practice. We’re fortunate not to be called on [like] that every day.”

While the job of White House counsel differs with each President, and brings a barrage of unique situations, there is one constant. “You have to be able to say no [to the President],” Fielding explains. “And you have to be able to be willing to say no even if you think you will be, not literally, executed. You still have to say no. That’s your job and somebody has to do it.”

Fielding’s staff in the Reagan White House included John Roberts, the future Chief Justice of the United States Supreme Court. Fielding turned paternal when I asked him about Roberts: “I have been really blessed in both the Bush and Reagan years. I could assemble a staff with great people. . . . One of the nicest things about doing private practice, but especially government service, is to watch your people and how they make you very proud.”

The Reagan Assassination Attempt: Setting Al Haig Straight

On the afternoon of March 30, 1981, just two months after entering office, President Reagan was shot in the chest while exiting the Washington Hilton following a luncheon speech to a labor union. [Three others were shot and survived.] The President had discussed the speech with his senior staff earlier that day. There wasn’t enthusiasm amongst the lot to attend. “There are some events that people want to go to. This was not one of them,” Fielding explaines, chuckling. He didn’t attend and was in his office when the call came – “Rawhide is down.” [Rawhide was Reagan’s Secret Service code name.] From there it was off to the Situation Room.

Of all the stories to come out of that day, none is as well-known as Secretary of State Alexander Haig telling the press corps, and a nationally televised audience, that he was “in control” of the White House. But he wasn’t. It would be Fielding who set Haig straight.

The situation grew out of confusion over who was in charge of the government. The President was getting ready for life-saving surgery and the Vice-President was on an airplane headed back to D.C. from Texas. Deputy Press Secretary Larry Speakes was in the White House Briefing Room -- floundering in his attempt to explain who was running the government to the assembled press. Haig, watching the fiasco unfold on television, rushed to the Briefing Room, stepped to the microphone and pronounced: “Constitutionally gentlemen, you have the President, the Vice-President and the Secretary of State, in that order, and should the President decide he wants to transfer the helm to the Vice-President, he will do so. As for now, I’m in control here, in the White House, pending the return of the Vice-President and in close touch with him. If something came up, I would check with him, of course.”

But Haig, the four star general and former Supreme Allied Commander of NATO, had it wrong. And it was Fielding who broke the news to him. Following Haig’s pronouncement a debate emerged, between Haig and Secretary of Defense Caspar Weinberger, over the question of control. Fielding recounted the story: Haig turned to Weinberger and said, “You’d better learn your Constitution, buddy.” Haig then turned to Fielding and asked “Isn’t that right, Fred?” Fielding’s response: “No, it’s not.” As Fielding described it to me, the issue was not a Constitutional one. It was tied to crisis management and contingency plans, under which “the authority to do certain things doesn’t devolve to the Secretary of State. It devolves to the Secretary of Defense.”

The 9-11 Commission

From 2002 to 2004, Fielding served as one of ten commissioners on The National Commission on Terrorist Attacks Upon the United States -- the so-called “9-11 Commission.” It was authorized by Congress to examine the circumstances surrounding the terrorist attacks, preparedness and the immediate response. The Commission was also mandated to provide recommendations for guarding against future attacks. It interviewed over 1,200 people and reviewed over two and a half million pages of documents before issuing a 500-plus page report.

Fielding described the experience as very significant and challenging, but the frustration in his voice is obvious: “It was designed to fail like all commissions. You know nobody reads them, nobody cares about them. There was really a design to make sure that wasn’t so, but we still had, if you recall the hearings, they were sometimes pretty contentious, they were also pretty partisan. When we got down to writing it we debated every sentence in that damn book. The thing that finally decided it was that we would footnote everything and we’d take out the adjectives. Viola. Unanimity. How can you fight that?”

Reagan And The Jelly Beans

President Reagan’s love for jelly beans was no state secret buried at Langley. I asked Fielding to describe the protocol for partaking in the President’s Oval Office stash. Could you simply help yourself? Or did you have to wait for the Gipper to start eating them first? Sadly, my hopes of breaking an inside the Beltway story were crushed. “I never had a jelly bean in the Oval,” Fielding tells me. But that’s not to say they weren’t a perk of the job. “We had senior staff meetings where he would invite us for lunch and of course there would be jars all over the place.”

The Washington Insider

Since leaving the Bush White House in 2009 Fielding is back where he started. His work at Morgan Lewis includes government relations, internal investigations, crisis management, white collar litigation, mediator and strategic advisor.

Stories about Fred Fielding almost invariably describe him as the quintessential Washington insider lawyer. His tremendous gravitas, experiences and earned respect of others have made him the proverbial man to see. In a town with a lot of secrets, Fielding surely knows as many as anyone. I wouldn’t be surprised if he knows if Oswald acted alone. But despite all this, he has a regular guy way about him. He’s solicitous, quick with a laugh and tells stories involving himself -- but without making them about himself. You get the sense that he treats those of tremendous power and a teenage barista with the same respect.

So just what does it mean to be a Washington insider? Fielding chuckles at the question. “I know they say that,” he acknowledges. “The magic is in relationships but it’s not in devious relationships. It’s building a reputation so that people rely on your judgment, number one, on one side, and people rely on your word. If that makes you a quintessential insider, maybe it does. But I think it means all things to all people. It’s whatever you think it’s going to be.” But it’s out of Fielding’s control. “You can’t help what people call you.”

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

|

|

|

|

| |

As much as I think Insurance Key Issues should be considered the most important legal source since the Ten Commandments, I do know its rightful place amongst such things. Deep down I know it’s just a sleepy insurance law book. The fact that it is usually ranked somewhere around the 4,000th best-selling Law book on Amazon, out of the many thousands offered for sale, seems about right.

But thanks to the huge popularity of the “Cyber Week” sale – 50% Off -- Key Issues rocketed to #21 on the Amazon best seller list for Law books. It didn’t stay there long – but for a time it was breathing the same air as real law books. Thank you CO readers!

With this kind of excitement for the Cyber Week sale I am delighted to announce that it has been extended through year-end.

Insurance Key Issues provides in-depth 50 state surveys (plus D.C.) of 20 of the most important liability coverage issues (and about half of the issues are relevant to professional liability claims as well as GL). At close to 1,000 pages, these are not charts or one-line answers as some 50 state surveys are.

To learn more about the book, and to order, visit the Insurance Key Issues website:

http://insurancekeyissues.com

#Stockingstuffer |

| |

| |

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Insurance Coverage For Lost Memory

|

|

|

|

|

| |

I've seen a lot of cases addressing whether certain damage qualifies as "property damage" to trigger a Liability or Property policy. But man I've never see this before.

Marvin Mendelson tripped while walking down the street in Roswell, New Mexico. He has no one to blame but himself. Mendelson was staring at his phone, playing on-line Dungeons and Dragons, when he failed to see a set of steps leading into a coffee shop. Mendelson went down hard and lost consciousness. He spent six days in a coma. When he awoke doctors determined that he suffered no serious physical injuries. However, he lost certain parts of his memory. The hope was that it would return over time.

But two months after the incident very little of Mendelson's memory had been restored. He sought help and learned that hypnosis might be the answer. Unfortunately, Mendelson's health insurance would not cover the treatment and he could not afford to pay for it out of pocket.

Mendelson turned to his homeowner's policy, which provides coverage, in part, as follows: Coverage C. – Personal Property: "We cover personal property owned or used by an 'insured' while it is anywhere in the world."

Mendelson's homeowner's insurer, Alien Property and Casualty, denied coverage. Alien P&C advised Mendelson that, while his loss of memory was unfortunate, it is in no way lost personal property.

Mendelson, facing the need for possibly several thousand dollars of hypnosis treatment, to restore his memory, retained a lawyer. Counsel sued Alien P&C, in Chaves County, New Mexico, seeking a declaratory judgment that Alien's homeowner's policy provides coverage to Mendelson, for his hypnosis treatment, on the basis that he sustained a loss of personal property.

Alien P&C filed a motion for judgment on the pleadings. But the court was not as convinced as Alien that the claim was "outlandish," as the insurer characterized it. To the contrary, the New Mexico District Court, in Marvin Mendelson v. Alien Property & Casualty Ins. Co., No. 17-2165 (5th Judicial Dist. Ct. (Chaves Cty., N.M.) Nov. 20, 2018) held that Mendelson's hypnosis treatment qualified for coverage, on the basis that his loss of memory was a loss of personal property.

Alien's argument was that one's memory is in no way "property." Specifically, memory is not tangible property, Alien argued, because it cannot be touched. And it is not intangible property, the insurer maintained, because, even if it incorporeal and cannot be touched, and, thus, intangible, its ownership cannot be transferred and the holder of the memories has no rights in them. Thus, memories are not intangible "property."

The court agreed that memories are not intangible property, as they cannot be transferred and the holder of memories has no rights in them. However, the court concluded that memories – at least some -- are personal property on the basis that they are tangible property.

The court put it this way: "Alien's mantra, repeated over and over in its brief, is that memories cannot be touched, so, therefore, they cannot be tangible property. However, the flaw in Alien's argument is the memories are things in life that we hold onto. See Taylor Swift, "New Year's Day," Reputation, Big Machine Records (2017) ("Hold on to the memories, they will hold on to you."). If memories are things we hold onto, then, by definition, they are touched." Mendelson v. Alien P&C at 4. In addition, the court noted that the policy provided coverage for "personal property owned or used by an 'insured' while it is anywhere in the world." The court stated that "anywhere in the world has no limits. Thus, it can include inside one's head." Id. at 5.

However, it was not a total victory for Mendelson. The court concluded that not all memories are things we hold onto. The court drew a distinction between memories of experiences, which are ones that people hold onto, and memories of facts, which are not. Thus, Alien's policy would provide coverage for hypnosis treatment to restore Mendelson's memory of lifetime experiences, such as family events, trips, holidays, friendships and school experiences. But it would not provide coverage to restore Mendelson's ability to state, verbatim, the entire dialogue of eleven episodes of Star Trek, including the classic "Trouble With Tribbles." Thus, it would be necessary for the hypnotist to allocate his or her time spent providing treatment to restore these two types of memories.

|

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

|

| |

|

| |

|

|

|

| |

|

Vol. 7 - Issue 9

December 19, 2018

Encore: Randy Spencer’s Open Mic

Is There Coverage?: Child Gets His Tongue Stuck On A Frozen Pole

|

|

|

|

|

| |

[This Randy Spencer’s Open Mic column appeared in the January 14, 2015 issue of Coverage Opinions. It has a tie to A Christmas Story. Since Turner Broadcasting has a tradition of showing that film for 24 consecutive hours on Christmas, surely I can get away with re-publishing this column here.]

A Christmas Story is more than just a movie. Nine-year-old Ralphie Parker’s dream of receiving a Red Ryder Carbine Action 200-shot Range Model air rifle for Christmas, has become part of American pop culture. The movie is most famous for the scene where Flick, in response to a Triple Dog Dare, places his tongue on the school yard flag pole believing that, despite the frigid temperature, it will not stick. We all know that it did. Then the bell sounded, signifying the end of recess, and Flick was left all alone stuck to the pole.

The news is full of stories about kids, wondering if that could really happen, who gave it a try. And some of them learned the hard way that A Christmas Story isn’t all fiction. Doing this, especially the pulling off part, can cause serious injury.

It not at all surprising that one youngster, who was inspired by Flick, filed suit on account of injuries sustained when his tongue became stuck to the tetherball pole in his friend’s backyard. Equally not surprising, the suit gave rise to coverage litigation. I’ve been waiting all year for the “Open Mic” column near Christmas to tell this story.

Six year-old Mitchell Turner slept over his friend Tim Morgan’s house in Burnsville, Minnesota during Christmas break in 2012. The two watched A Christmas Story before going to bed. The next morning they were in Tim’s back yard, the temperature was in the single digits, and Tim dared Mitchell to stick his tongue on the tetherball pole. You can see where this is going. Mitchell did so and it became stuck. He panicked, instinct took over, and he pulled his tongue off, losing a piece of it in the process. The injuries, and long term consequences, are serious.

Mitchell’s mother, as guardian for her son, filed suit against Tim’s parents for failure to supervise the boys in the backyard. She also named the tetherball pole manufacturer for products liability – defective product and failure to warn. The complaint in Gloria Turner, as Guardian for Mitchell Turner v. Barbara and Michael Morgan, et al., District Court of Minnesota, Dakota County, No. 13-7543, alleged that, because Tim’s parents knew that the boys had watched A Christmas Story, it was reckless to let them go outside the next morning, unsupervised, in an area that included a tetherball pole.

The commercial general liability insurer for the pole manufacturer undertook its defense in the underlying Turner suit. The homeowner’s insurer for the Morgans, 10,000 Lakes Property Casualty, disclaimed coverage based on no occurrence. The Morgan’s retained their own counsel.

The defendants filed summary judgment on the basis of assumption of the risk. It was not disputed that Mitchell had watched A Christmas Story the night before the incident and saw the scene where Flick got his tongue stuck to the pole. The court granted the motion based on Toetschinger v. Ihnot, 250 N.W.2d 204 (Minn. 1977), where the Minnesota Supreme Court held that, in appropriate cases, children under seven years of age can be held contributorily negligent. Here the court concluded that it applied to Mitchell as a matter of law.

While the case was now over, and no appeal was filed, the Morgans incurred $12,000 in defense costs. They filed suit against 10,000 Lakes P&C, seeking payment of their defense costs and damages for the insurer’s bad faith denial of coverage. At issue in Morgan v. 10,000 Lakes P&C, District Court of Minnesota, Dakota County, No. 13-9862, was whether Mitchell’s injury was caused by an occurrence when the Morgans failed to supervise the boys, knowing that they had watched A Christmas Story the night before and their backyard had a tetherball pole.

The 10,000 Lakes court described the issue as “unique to say the least.” The court undertook an examination of Minnesota law concerning the “occurrence” issue and set out a laundry list of decisions that have confronted whether certain injury-causing conduct was an accident. Following this lengthy examination, the 10,000 Lakes court held that the injury sustained by Mitchell was not caused by an accident.

The court explained its conclusion as follows: “Minnesota courts have long held that, for purposes of a liability insurance policy, an ‘accident’ is an ‘unexpected, unforeseen, or undesigned happening or consequence from either a known or an unknown cause.’ Simply stated, the Morgans had to appreciate that six year old boys, with insatiable curiosity, a limitless spirit of adventure and A Christmas Story still fresh in their minds from just twelve hours earlier, would see the tetherball pole and be drawn toward it like moths to a porch light. Despite this, the Morgans did nothing to prevent the inevitable. From the Morgans’ perspective, Mitchell’s loss of his tongue was not an unexpected, unforeseen, or undesigned happening. The Morgans’s conduct speaks for itself.”

|

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

|

| |

|

| |

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Read This After Reading This Issue Of Coverage Opinions |

|

|

Thank you for reading this issue of Coverage Opinions.

Did you find all of the information you were looking for?

Would you like to donate $1 to people who do not own a copy of ISO’s CG 00 01 04 13 form?

Are you a member of the Coverage Opinions frequent reader club?

Would you like to take a survey about Coverage Opinions and save 10% off the next issue?

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

For Your Insurance Coverage Christmas Tree

|

|

|

|

| |

I don’t celebrate Christmas. But I love looking at people’s Christmas tree decorations and hearing great backstories about how some of the ornaments were obtained. But if I did celebrate the holiday, oh what fun it would be to have these ornaments on the tree. |

| |

| |

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Three Thanksgiving -- Insurance Coincidences

|

|

|

|

This was crazy: three Thanksgiving-related insurance coincidences took place just days before the holiday.

On November 15, the Eastern District of North Carolina issued its decision in Great American E&S Ins. Co. v. Butterball, No. 18-113 (Nov. 15, 2018). At issue was coverage for an environmental pollution claim under a policy that provides coverage for premises environmental liability. Unknown liquids were leaking from tanks and the total remediation costs were going to be $3,500,000. The decision in the declaration judgment was purely procedural – a forum fight as Butterball and the insurer had each filed their own coverage action.

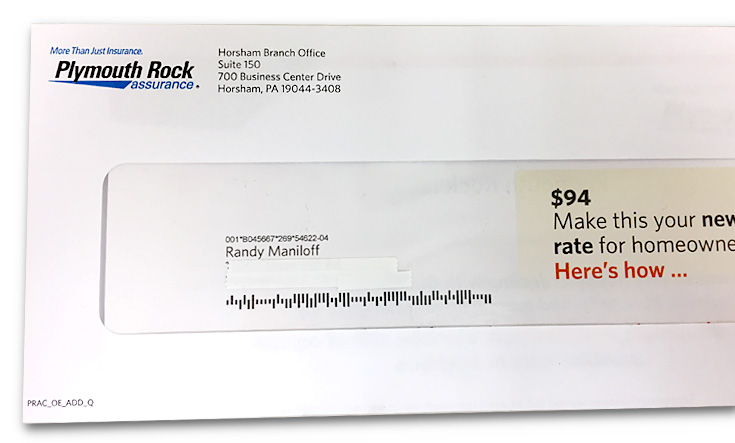

Then, the week before Thanksgiving, I received a homeowner’s insurance offer in the mail from Plymouth Rock Assurance.

|

|

|

| |

But wait, the Thanksgiving coincides don’t stop there. The last issue of Coverage Opinions, in the “Randy Spencer’s Open Mic” column, mentioned Plymouth Rock Assurance, joking that all it did was insure Thanksgiving-related risks.

Oh, to answer your question – where do you go to get back the time you lost reading this? You don’t. Sorry. |

| |

| |

| |

|

|

|

|

| |

|

Vol. 7 - Issue 9

December 19, 2018

Study: Insurers Win 80-90% Of Federal Court Liability Coverage Cases |

|

|

I’ve reviewed the Lex Machina (a Lexis company) 2018 Insurance Litigation Report published in October. The 24-page report contains a staggering amount of information and statistics – some of it eye-glazing -- concerning the 93,000 federal district court coverage cases filed between 2009 and 2017.

The report goes well-beyond business liability cases. It also includes information concerning life insurance, auto, UM/UIM and homeowners (hurricane and non-hurricane). The report excludes cases involving interpleader, surety bonds, subrogation, Medicare, Social Security and ERISA.

I list below some of the findings that I believe will be of most interest to CO readers. The upshot of the Lex Machina report is that it clearly provides data for both insurers and insureds to consider when deciding to go down the litigation road -- as well as how far to proceed.

- The number of business liability cases filed, between 2009 and 2017, has hovered around 3,000 per year (closer to 2,500 for the past three years).

- In cases with a duty to defend finding, 80% are in favor of insurers (case terminations 7/1/14 to 6/30/18).

- In cases with a duty to indemnify finding, 85% are in favor of insurers (case terminations 7/1/14 to 6/30/18).

- Where the issue was the existence of an “occurrence,” the court found no occurrence about two-thirds of the time.

- In cases involving bad faith (case terminations 7/1/14 to 6/30/18), 90% found no bad faith on the part of the insurer (with about 75% resolved by summary judgment); at trial, bad faith findings were close to evenly split, with insurers winning slightly more.

- While insurers won a lot more cases than they lost, that’s not to say that policyholders did not obtain coverage. About two-thirds of cases involving business liability policies were resolved by a dismissal, which Lex Machina concludes was the likely result of a settlement (case terminations 1/1/09 to 6/30/18)

- For four jurisdictions the report looks at the median number of days for a case to reach summary judgment (case terminations 7/1/14 to 6/30/18): C.D. Calif.: 343; S.D. Tex.: 475; S.D.N.Y.: 524; N.D. Ill.: 567.

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Congratulations Michael Teitelbaum: Ontario Insurance Law & Commentary (2019 Edition) Released

|

|

|

|

I am pleased to report that Lexis recently published the 2019 Edition of Ontario Insurance Law & Commentary by Michael Teitelbaum of Toronto’s Hughes Amys LLP.

Lexis puts it this way: “This concise guide to insurance law in Ontario is designed for insurance law practitioners, in-house counsel, insurance companies and professionals. The commentary, prepared by Michael S. Teitelbaum of Hughes Amys LLP, provides an overview of the principles and key issues in liability, property and life insurance plus an annotated review of selected key provisions of the Insurance Act. Other features include the full text of the Act and related legislation.”

As someone who knows the challenges of writing an insurance law book, I always enjoy congratulating someone who has done that, as well as checking out how they approached the task.

Michael and his colleagues take an interesting, unique and effective tack to presenting the information in Ontario Insurance Law & Commentary. They strive to encapsulate, annotate and update Ontario’s (and, as readers will see, common law Canada’s) insurance law on an annual basis. |

|

|

|

| |

It's also interesting to see the similarities and differences between Ontario/Canadian law and U.S. insurance law. From time to time, Michael sprinkles in some U.S. law references in the Commentary’s footnotes noting their potential relevance to Canadian law. I was flattered to see some references to this newsletter when he does that.

Michael advises that among the most interesting cases discussed in the latest edition are:

- Oliveira v. Aviva Canada Inc., in which the Ontario Court of Appeal upheld the application judge’s finding that the insurer had a duty to defend the privacy tort claim of intrusion upon seclusion, observing that the unauthorized access to hospital records was ‘precisely the sort of conduct [this professional and general liability] policy was intended to respond to’;

- The Ontario Court of Appeal’s decision in Usanovic v. Penncorp Life Insurance Company (La Capitale Financial Security Insurance Company), which was released just as the 2018 Commentary was going to press, upholding the motion judge’s dismissal of this LTD benefits action as limitation-barred because the insurer did not breach its duty of good faith by failing to inform the insured of the limitation period when it terminated his benefits as there was no statutory obligation to do so in Ontario; and

- Aviva Insurance Company v. Intact Insurance Company, where the Ontario Superior Court found that liability coverage was complementary and not overlapping, the insurer provided primary and not excess coverage, and was obliged to contribute to the costs of defence and settlement.

I can’t imagine someone, who has anything to do with Ontario insurance law (or, indeed, insurance law in Canada for that matter, particularly the common law provinces, but also Quebec where I understand some of the common law decisions have some application), not having Ontario Insurance Law & Commentary at their fingertips. Congratulations Michael on the 2019 edition of this must-have book.

More information, and how to order, is here.

And, anyone interested in keeping abreast of Canadian (and particularly Province of Ontario), insurance and tort law may wish to check out the Blawg posts on Hughes Amys LLP’s website, at http://www.hughesamys.com/blawg.

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Insurer Provides Defense And Indemnity: And May Still Be In Bad Faith |

|

|

The law of bad faith can be complex and it is certainly voluminous. But, as a general principle, it arises in the context of an insurer that has failed to pay a claim that it otherwise should have. But that’s not what happened in Higginbotham v. Liberty Ins. Corp., No. 18-747 (W.D. Pa. Nov. 27, 2018). Here the insurer defended its insured under a reservation of rights, litigated coverage and then settled the claim. End of story, right? No. The Pennsylvania federal court concluded that the insurer could still be in bad faith.

At issue was coverage for Erica Higginbotham, under a homeowner’s policy, for claims arising out of sexual abuse by her father-in-law of children whom Higginbotham was babysitting. In particular, Higginbotham was sued for negligent supervision of the children and failing to recognize the risk that her father-in-law posed.

Liberty Insurance, the homeowner’s insurer, undertook Higginbotham defense under a reservation of rights, citing several exclusions. Liberty and Higginbotham each filed declaratory judgment actions on the issue of whether coverage was owed for defense and any liability. Liberty filed in federal court. Higginbotham went the state court route. The court in the federal action declined jurisdiction on account of the parallel state action. Liberty filed a counterclaim in the state action. Liberty’s motion for judgment on the pleadings was denied. An appeal to the Pennsylvania Superior Court was quashed. The underlying action was settled by Liberty and the state court declaratory judgment action was now over. Phew.

But that wasn’t the end of the story. Higginbotham filed a complaint against Liberty, in Pennsylvania state court, asserting a claim for statutory bad faith and contractual bad faith. Liberty removed the bad faith action to federal court and filed a motion for judgment on the pleadings. The court denied the motion with respect to both the contractual bad faith claim and statutory bad faith claim.

The parties competing positions were as follows: Liberty argued “that it was entitled to judgment on the pleadings because it did not act in bad faith (1) by filing the federal action and a counterclaim in the state action while providing Higginbotham with a defense in the underlying lawsuit, or (2) in its handling of the issues surrounding the underlying litigation. In her response, Higginbotham argues that Liberty’s issuance of a ‘manipulative’ reservation of rights and use of the courts to delay resolution of the underlying litigation in order to ‘improve its negotiating position,’ was done in bad faith, and caused her to suffer emotional distress and bodily harm and to incur legal expenses to defend herself against Liberty’s unfounded declaratory judgment actions.”

On the contractual bad faith claim, the court was mindful that “Pennsylvania Supreme Court precedent allows the insurer to defend subject to a reservation of rights [and] . . . applicable caselaw encourages insurers to file declaratory judgment actions.” However, despite the fact that Liberty did both of these things, it was still not insulated from the possibility of bad faith: “It is undisputed that Liberty investigated the underlying lawsuit once the complaint was brought to its attention; that Liberty provided Higginbotham with counsel, subject to reservation of rights; that Higginbotham chose to hire private counsel to litigate Liberty’s declaratory judgment motions; and that the underlying lawsuit was ultimately settled. However, the thoroughness of that investigation, applicability of the exclusions relied upon by Liberty, and propriety of delaying settlement for two years to actively pursue declaratory relief against its insured present unsettled questions of fact. Viewing the evidence in the light most favorable to Higginbotham, a reasonable jury could find that Liberty’s actions, in the aggregate, constituted a bad faith breach of its contractual duties to Higginbotham, and could lead that jury to return a verdict in her favor.”

On the statutory bad faith claim -- 42 Pa.C.S. § 8371 – the court concluded that the “focus in section 8371 claims cannot be on whether the insurer ultimately fulfilled its policy obligations, since if that were the case then insurers could act in bad faith throughout the entire pendency of the claim process, but avoid any liability under section 8371 by paying the claim at the end.... [T]he issue in connection with section 8371 claims is the manner in which insurers discharge their duties of good faith and fair dealing during the pendency of an insurance claim, not whether the claim is eventually paid.” (emphasis added).

At least at this stage, the court was not willing to say that there was no possibility of bad faith: “The allegations in the pleadings demonstrate that there are outstanding material issues of fact which could lead a reasonable jury to conclude that Liberty’s investigation and claim-handling was motivated by its own self-interest, and in bad faith, regardless of the fact that the claim was ultimately paid.”

I do not know enough about the “manner” in which the claim was handled by Liberty to address the decision in any detail. Bad faith cases are often fact-driven. And the court’s decision was on a motion for judgment on the pleadings – which could have a lot to do with it. But, in general, when an insurer defends under a reservation of rights and files a declaratory judgment action (two things that are judicially encouraged) and then settles the underlying action, and can still face a subsequent bad faith claim, insurers should take notice.

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

New Decision Shows Yet Another Possibly “Ineffective ROR” Issue

The Need For Multiple ROR Letters |

|

|

Readers of Coverage Opinions know that I have been on a mission, of sorts – going back at least 6 years -- addressing the need for insurers to draft reservation of rights letters that “fairly inform” the insured of the reasons why the insurer, despite that it is providing a defense to the insured, may not in fact be obligated to provide coverage for certain claims or damages in a suit. In other words, an ROR that cites some facts, and then quotes some policy provisions, and then says, viola, we reserve our rights, is at risk for being found to be ineffective. Translation - the insurer has waived its defenses.

Several decisions, from state appellate courts over the past few years, have found ROR letters to be ineffective for this reason. And there are plenty of cases before these. And this trend continued with the just-adopted ALI Liability Insurance Restatement, which includes this fairly inform standard in its ROR requirements section.

But there is another potential insurer-misstep when it comes to ROR letters. And it is one that I see insurers fall afoul of not infrequently. Moreover, it is a risk that exists even if the ROR does a great job satisfying the “fairly inform” standard. An ROR may be ineffective if it is not sent to all insureds being defended under an ROR. Think of the situation where a company, the named insured, is sued along with several employees. The insurer undertakes the defense of the company and employees. However, the ROR is only sent to the company and not the employees too. In this situation, and analogous ones, court decisions have held that there is no ROR in place for the employees.

For example, the Pennsylvania Superior Court held in Erie Insurance Exchange v. Lobenthal (2015) that a reservation of rights letter was never provided to an adult-defendant, who was a resident in her parents’ home, because the letter -- that was intended to be a reservation of rights -- was addressed to her parents. The court held: “[W]e refuse to attribute notice to Michaela based on the fact that she was living with her parents at the time. Michaela was an adult at the time the lawsuit was filed, and there is no evidence that she actually read the letter. Michaela was the defendant in the underlying tort action, and the letter should have been addressed in her name.” The fact that the ROR was sent to Michaela’s lawyer also did not save it. Thus, despite that the insurer should have owed no coverage to the insured, on account of an exclusion, such was not to be the case, as no reservation of rights letter was ever sent to her.

In reaching its decision, the Pennsylvania appeals court relied, in part, on Knox-Tenn Rental Co. v. Home Ins. Co., 2 F.3d 678 (6th Cir. 1993), a decision that concluded that there was no reservation of rights in place for an employee, because the letter was not sent to him, despite the fact that it was sent to his employer.

On October 23, 2018, in Starr Indem. & Liab. Co. v. Verticals, LLC, No. 16-2832 (M.D. Tenn. Oct. 23, 2018), the Tennessee federal court, for various reasons, declined to find that a reservation of rights letter was ineffective for failing to meet the “fairly inform” standard – although it made clear that that was the required test. The court also declined to conclude that sufficient notice of the ROR was not provided. However, in doing so, the court, with a citation to, and description of, Knox-Tenn Rental Co. v. Home Ins. Co., was clear that the “notice of an ROR to all insureds standard” applies.

This can be an administratively complex issue – sending 3 or 4 or 5 ROR letters for a claim. Thankfully my clients are used to this issue and we’ve worked out some ways to address it. But can it be an administrative challenge? Yes. It’s just the nature of the ROR beast. But to do all the work to satisfy the “fairly inform” standard, and then have the ROR be ineffective because it was not sent to all insureds, is an unfortunate situation.

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Washington High Court To Address A Significant Additional Insured Issue |

|

|

It is an issue that often surprises policyholders. Company A obligates Company B to name Company A as an additional insured on Company B’s liability policy. Company B obtains a lability policy and secures a Certificate of Insurance that states that Company A, the certificate holder, is an additional insured on Company B’s liability policy. It seems OK so far. Then Company A seeks coverage, as an additional insured, from Company B’s liability insurer. Company B’s liability insurer responds that, despite what the COI may say, about Company A being an additional insured, Company A is not in fact an additional insured. Company A’s response is to be perplexed -- and then some.

Insurers usually win these cases. First, while the Certificate of Insurance states that Company A is an additional insured on Company B’s liability policy, the COI also likely states, six ways from Sunday, and some are written in all caps, that the COI is issued for information purposes only, does not amend the policy and confers no rights upon the certificate holder, especially additional insured rights.

Another reason insurers usually win these cases is that the party that issued the COI was often-times not authorized to speak for the insurer in the first place. For example, the COI may have been issued by the named insured’s broker, which had no authority to bind the insurer.

Thanks to the Ninth Circuit’s request in T Mobile United States v. Selective Insurance, No. 17-35932 (9th Cir. Nov. 9, 2018), the Washington Supreme Court may resolve this additional insured issue: A party is listed as an additional insured under a Certificate of Insurance. And, importantly, the COI was issued by the insurer’s authorized agent, and not simply a broker for the named insured. However, the COI also contains all of the language noted above stating that it confers no rights on the party seeking coverage as an additional insured.

The Ninth Circuit concluded that this issue involves two principles of Washington insurance law that are at “loggerheads:” First, “under Washington law, an insurance company is bound by all acts, contracts, or representations of its agent, whether general or special, which are within the scope of [the agent’s] real or apparent authority. The second is that under Washington law, the purpose of issuing a [COI] is to inform the recipient thereof that insurance has been obtained. Accordingly, under Washington law, a COI is not the functional equivalent of an insurance policy, and it therefore cannot be used to amend, extend, or alter the coverage provisions of an insurance policy.”

Noting that this critical question of Washington law is not settled, the Ninth Circuit certified the following question to the high court of Washington (which can accept it or not): “Under Washington law, is an insurer bound by representations made by its authorized agent in a certificate of insurance with respect to a party’s status as an additional insured under a policy issued by the insurer, when the certificate includes language disclaiming its authority and ability to expand coverage?”

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Washington Federal Court:

State Supreme Court’s Widely Discussed Xia Decision Does Not Grant Coverage |

|

|

I have discussed the Washington Supreme Court’s April 2017 decision in Xia v. ProBuilders Specialty Insurance Company a few times. Briefly, the Washington high court held that carbon monoxide, released from a negligently installed vent, attached to a hot water heater, was a “pollutant.” At issue were claims for bodily injury by a homeowner against a home builder. However, the Xia court still held that the pollution exclusion did not apply. The court got to this result by adopting the “efficient proximate cause” rule -- which provides that coverage is owed if a covered peril sets in motion a causal chain, the last link of which is an uncovered peril. This is usually seen in property coverage cases. However, the court noted that there was nothing to say it couldn’t apply to any type of policy.

Applying the “efficient proximate cause” rule, the court held that the pollution exclusion did not apply. The court determined that the efficient proximate cause of the injuries was the negligent installation of the hot water heater. Because this was a covered occurrence, that set in motion a causal chain, that led to discharging toxic levels of carbon monoxide, being an excluded peril, the pollution exclusion was not applicable. In other words, the pollution exclusion did not apply because two or more perils combined in sequence to cause a loss – one covered and one not -- and a covered peril was the predominant or efficient cause of the loss.

In the last issue of Coverage Opinions I discussed ISO’s recent filing of endorsements designed to address the Xia decision. Essentially, the endorsements provide that, if an exclusion would have precluded coverage, but the exclusion is rendered inapplicable, on account of the efficient proximate cause rule from Xia, then the exclusion does not apply. In other words, the endorsements accept that Xia may preclude the applicability of an exclusion. However, in such case, while the claim may now be covered, it is subject to the newly created “Efficient Proximate Cause Aggregate Limit.”

But, despite all the hubbub about Xia, a Washington federal court recently declined to apply it to find coverage that would not have otherwise been owed. In Safeco Ins. Co. v. Wolk, No. 18-5368 (W.D. Wash. Oct. 25, 2018), the court addressed the availability of homeowner’s coverage, for claims against a husband and wife (Ben and Michelle Work), for Ben’s alleged sexual assault of a minor female guest in the home (Ruby Nicholls). The claim against Michelle was that she knew or should have known of Ben’s conduct and did not protect Ruby.

The insurer, Safeco, undertook a defense for Michelle (but not Ben) and reserved rights on several grounds, including no “occurrence” and certain exclusions. Litigation ensued.

The Wolks argued that, vis-à-vis Michelle, there was an “occurrence” and the exclusions did not apply because the claims against her were not intentional. Rather, it was alleged that her liability was based on negligent supervision of her husband. The court did not agree. In doing so, it rejected the Wolks’ argument that Xia dictated coverage:

“The Wolks also argue that Michelle’s allegedly negligent supervision of her husband may be the efficient proximate cause of his sexual abuse of Nicholls. There are at least two flaws with this argument, one legal and one factual. First, the efficient proximate cause rule provides coverage where ‘a covered peril sets in motion a causal chain, the last link of which is an uncovered peril.’ Xia, 400 P.3d at 1240. While Xia may have suggested that the efficient proximate cause rule can theoretically apply in a broader-than-previously-thought range of insurance coverage cases, its actual holding was not remarkable: [discussion of Xia] . . .

Xia does not hold or suggest that the efficient proximate cause of an excluded intentional act can be negligence, or the negligent supervision of the intentional actor. Nor does any other case discussing the efficient proximate cause rule suggest that it can or should be applied in such a manner.

The factual flaw in the Wolks’ argument is that Nicholls does not allege that Michelle’s negligence caused the sexual abuse, or that if she knew or should have known it was going to occur in the future. Her complaint alleges that Michelle ‘knew or should have known of the behavior complained of herein’—Ben’s sexual abuse of Nicholls—and that she ‘had a duty to protect’ Nicholls, which she ‘failed to do.’ It is not possible that the efficient proximate cause of the sexual abuse was Michelle’s knowledge that it was happening and her failure to stop it.”

I do not see this decision as some sort of rejection of Xia. Rather, it seems to have been dictated by the facts at issue concerning causation. Indeed, the court observed that Xia itself was cause/fact driven.

|

|

|

|

|

|

|

Vol. 7 - Issue 9

December 19, 2018

Third Circuit Puts The Kibosh On A Pennsylvania Self-Defense Exception To “Four Corners” |

|

|

I have always considered Pennsylvania to be a strict “four corners” state for purposes of determining an insurer’s duty to defend. [An exception being that a court may be willing to ignore a “negligence” allegation if the complaint belies that a defendant-insured’s actions could have been negligent.]

In the last issue of Coverage Opinions I addressed Lupu v. Loan City, LLC, No. 17-1944 (3d Cir. Sept. 10, 2018) (published), where the strictness of Pennsylvania’s “four corners” test was further stated. The Third Circuit in Lupu acknowledged that Pennsylvania has long employed the “four corners” test for purposes of determining an insurer’s duty to defend. The court also had no hesitation pointing out shortcomings of the four corners rule: “[T]he inflexible application the ‘four corners’ rule allows an insurer to plead Sergeant Schultz’s ‘know nothing’ defense, and thereby successfully ignor[e] true but unpleaded facts within its knowledge that require it, under the insurance policy, to conduct the putative insureds defense.” Further, the court conceded that “harsh consequences [] can be wrought by the ‘four corners’ rule, and no doubt a wooden application leaves would-be insureds in the lurch if a covered claim is not identifiable in the complaint. But Pennsylvania courts tolerate this measure of concern in exchange for a clear rule’s benefit.” The court acknowledged that, under the four corners rule, the party seeking insurance is left at the mercy of the manner in which the underlying plaintiff pleads its case.

Despite this, in Unitrin Direct Ins. Co. v. Esposito, 280 F. Supp. 3d 666 (E.D. Pa. 2017), the Eastern District of Pennsylvania held that, at least in one situation, an exception to the four corners rule applied. But the Third Circuit recently put the kibosh on this when it reversed the District Court.

The District Court in Esposito had held that an insurer was obligated to defend its insured, Michael Esposito, for claims arising out of a bar fight. The court found that there was no occurrence. However, the insured argued that he was acting in self-defense of himself and his wife. The court concluded that the self-defense exception to the “expected or intended” exclusion applied.

The District Court saw it this way: “If a court could not look beyond the complaint in the underlying action alleging that the insured assaulted the plaintiff, an insured claiming self-defense could not invoke a duty to defend. How else could a court determine that an insured was claiming self-defense if it could not consider what his defense was in the underlying action? It could do so only by considering his answer in the underlying case or his answer in the declaratory judgment action. Otherwise, the insurer could avoid its duty to defend under the exception to the exclusion.”

But the Third Circuit, in Unitrin Direct Ins. Co. v. Esposito, No. 17-3810 (3rd Cir. Oct. 17, 2018) reversed, holding that, once the District Court concluded that there was no occurrence, it should have stopped there. At that point, the appeals court explained, the case was over, and there should have been no consideration of whether any exclusions, or exceptions to exclusions, applied.

Nonetheless, the Third Circuit went on to address the self-defense exception, to the “expected or intended” exclusion, and concluded that it did not apply to create a duty to duty. In the Third Circuit’s view, the test for determining an insurer’s duty to defend is “four corners.” The complaint alleged that Esposito, without provocation, punched, kicked and injured the plaintiff. Thus, the court concluded that there was no allegation in the complaint that Esposito acted in self-defense.

But of course there wasn’t any such allegation. This was the point made by the District Court. A plaintiff, in an assault and battery case, would not allege that the defendant acted in self-defense. To do so would be an admission by the plaintiff that he or she was an aggressor. This is why some “four corners” states apply an exception, that allows a defendant-insured to argue that self-defense can be considered when determining duty to defend, despite the absence of any self-defense allegations within the four corners of the complaint. But the Third Circuit did not go down this road. Four corners is four corners.

|

|

|

|

|

|

| |

|

Vol. 7 - Issue 9

December 19, 2018

Construction Site Bodily Injury Exclusion Applies To Both Upstream And Downstream Employees |

|

|

Over the past few years liability insurers have been adding endorsements to attempt to limit their exposure for bodily injury claims on construction sites (not to mention for property damage). One way that insurers have attempted to limit such exposure has been to amend their CGL policy’s “employer’s liability” exclusion to preclude coverage for bodily injury to employees of “any insured” -- as opposed to the standard language, which applies to preclude coverage for employees of “the insured.” In this way, coverage may not be owed to general contractors, that are additional insureds under policies issued to subcontractors, for injuries to employees of the subcontractor.

This is a common claim when there is a construction site injury. Since the amended exclusion precludes coverage for bodily injury to employees of “any insured,” no coverage is owed to the general contractor – as an additional insured -- even though the injured party is not an employee of the GC. In other words, it does not matter that the insured seeking coverage is not the employer of the injured party. The injured party is an employee of the named insured (subcontractor), which qualifies as “any insured.” There can be other variations of this scenario. And there are sometimes issues whether this interpretation can be supported when a policy has a separation of insureds provision.

Another tack insurers have taken has been to add exclusions that preclude coverage for bodily injury to an employee of any contractor at the site – period -- regardless of the employee’s relationship, or not, to a party seeking coverage. That’s a broad exclusion for sure.

In Northfield Ins. Co. v. Herrera, No. 17-51080 (5th Cir. Oct. 24, 2018), the Fifth Circuit addressed an exclusion on this type and upheld the broad interpretation sought by the insurer. A coverage dispute arose under the following circumstances. Charles Herrera ran an elevator service company under the name Austin Elevator Consultants. Austin Elevator and Herrera entered into a contract under which it would service, inspect, and maintain elevators in Austin Energy’s Sandhill Energy Center.

Thomas McCoy, an Austin Energy employee, was injured on a Sandhill Energy Center (SEC) elevator. He sued Herrera for negligence. Northfield, Herrera’s general liability insurer, defended Herrera under a reservation of rights and filed an action seeking a declaratory judgment that it had no duty to defend or indemnify Herrera.

Northfield argued that no coverage was owed to Herrera on the basis of the following exclusion:

This insurance does not apply to “bodily injury” to: ***

(3) Any person who is employed by, is leased to or contracted with any organization that:

(a) Contracted with you or with any insured for services; or

(b) Contracted with others on your behalf for services; arising out of and in the course of employment by that organization or performing duties related to the conduct of that organization's business; or ***

As Northfield saw it, the exclusion applied to the McCoy bodily injury suit as McCoy was an employee of Austin Energy, and, thus, was an employee of an organization that contracted with Herrera. As Herrera saw it, the exclusion applied solely to so-called downstream employees, i.e., employees of a Herrera subcontractor.

The district court found in favor of Herrera, based on an interpretation of exclusion (3)(a) in the context of other provisions of the exclusion. The court also “noted that Northfield’s ‘expansive reading’ of the exclusion would render its service ‘illusory,’ reasoning that ‘service-providing businesses like Herrera[‘s]’ purchase general liability insurance to cover bodily injuries to the employees of organizations that hire them.”

The Fifth Circuit reversed, finding that the language of exclusion (3)(a) – focusing on the phrase “contracted with”--was clear. While the court’s analysis included a detailed reading of the operation of paragraph (3)(a), in the context of other provisions of the exclusion – which I don’t address here, the court also noted that “[t]he policy does not indicate that the parties intended technical or industry-specific meanings for this phrase.” Thus, giving the phrase its ‘plain, ordinary, and generally accepted meaning’ -- looking at dictionaries, leading treatises on grammar and word usage – the appeals court held that “[t]he phrase ‘contracted with’ can be used to refer to upstream and downstream relationships.”

Lastly, the Fifth Circuit also squelched the district court’s illusory coverage argument: “Finally, Herrera protests that excluding this claim will render the policy’s coverage ‘illusory’ because the elevator in question is a service elevator and, therefore, only used by Austin Energy employees. Texas disfavors constructions of insurance contracts that render all coverage illusory. But when an insurance policy will provide coverage for other claims, Texas courts are unlikely to deem the policy illusory. Herrera will still be protected against claims brought by third parties, such as SEC’s vendors and visitors to the site. He will also be protected from claims relating to his other job sites. Therefore, the policy’s coverage is not illusory.”

|

|

|

|

|

|

| |

|

Vol. 7 - Issue 9

December 19, 2018

A “Number Of Occurrences” Fact Pattern I’ve Never See |

|

|

I’ve read a lot of “number of occurrences” decisions. There are a gazillion of them addressed in Insurance Key Issues. They involve seemingly limitless scenarios for which the number of occurrences must be determined. But there are also some that arise with regularity, including shootings, product failure, sexual misconduct, auto accidents, construction defect and exposure to asbestos and other hazardous substances.

In Auto-Owners Ins. Co. v. Long, No. 18A-CT-852 (Ct. App. Ind. Oct. 30, 2018) the Court of Appeals of Indiana addressed a number of occurrences scenario that I’ve never seen before. The decision seems pretty obvious. Yet the trial and appellate courts still disagreed.

Long involved coverage under the following circumstances. In February 2009, an employee of The Art of Design mailed a box containing ten bottles of a chemical product. The product contained toxic chemicals. While at a postal service processing facility the box was passed through a conveyor system known as the Singulator. The box broke open and a damaged bottle leaked onto a conveyor belt, releasing toxic fumes. The box was not labeled to say that it contained hazardous materials and it had been sealed by only a piece of masking tape. During the clean-up process, a postal employee was overcome by the fumes and went to the hospital. The employee died in 2016. His Estate claimed that he was permanently disabled as a result of injuries sustained by exposure to the chemical fumes and such exposure was a direct and proximate cause of his death in 2016.

The Postal Service determined that The Art of Design violated Postal Service regulations relating to both the labeling and packaging of hazardous materials. Had the box been properly labeled, it would not have been put through the Singulator but, rather, would have been hand-sorted.

At issue was coverage for Art of Design for the injuries sustained by the Postal employee. Specifically, number of occurrences – one or two -- which dictated the amount available for the claim -- $1,000,000 or $2,000,000 (presumably the aggregate limit).

The trial court found two occurrences – the insured failed to both properly label and package the box. But the appellate court, noting that a prior Indiana appellate court had adopted the “cause test,” for determining number of occurrences, disagreed: “While the Insured failed to both properly label and package the box, there was only one accident that resulted from the Insured’s failure to take appropriate preventative measures to avoid a spill. Stated differently, although the Insured did two things wrong in shipping the package, the wrongdoing resulted in one spill, i.e., ‘one proximate, uninterrupted, and continuing cause which resulted in’ Long’s injury.”

|

|

|

|

|

|

|

| |

|

|

Insurer “Closing Its File” Started Running Of Statute Of Limitations

There is a fair amount of case law addressing when the statute of limitations begins to run on a coverage dispute. In Williams v. Travelers Home & Marine Ins. Co., No. 17-17368 (9th Cir. Oct. 12, 2018) the Ninth Circuit held: “Under Nevada law, an insured’s limitations period does not begin to run until the insurer ‘formally denies’ liability or additional benefits. No magic words are necessary to constitute a denial of further benefits; rather the limitations period is triggered by ‘notif[ication] that [the] carrier has failed to fulfill its promise to pay a claim.’ Here, the limitations period was triggered by Travelers’ October 5, 2011 letter, which stated that Travelers was closing the claim file because the Williamses had failed to cooperate with Travelers’ previous two requests for inspection of the property and additional information in support of the claim. The letter (1) notified the Williamses that Travelers was ‘closing [its] file,’ and (2) referred the Williamses to their insurance policy’s ‘Suit Against Us’ provision, which set forth a two-year limitation period for breach of the policy. The letter put the Williamses on notice that Travelers would not make further payments on the claim.”

Insurers often use the words “closing its file” when addressing coverage with an insured, such as following a determination of no coverage or if an insured has not replied to a coverage investigation. But I’ve never seen the words “closing its file” have any formal impact on coverage. After all, can’t a closed file be re-opened?

Court Addresses Meaning Of Insured’s Request for “Soup To Nuts” Coverage

In Frederick Mutual Ins. Co. v. Hall, No. 17-3477 (3rd Cir. Nov. 8, 2017) the Third Circuit addressed the reasonable expectations doctrine in the context of coverage for construction defects under Pennsylvania law. Such coverage can be very hard to find under the law of the Commonwealth. Yet the lower court did -- based on the insured’s reasonable expectations of coverage. But the appeals court reversed, noting that there is “a crucial distinction between cases where one applies for a specific type of coverage and the insurer unilaterally limits that coverage, resulting in a policy quite different from what the insured requested, and cases where the insured received precisely the coverage that he requested but failed to read the policy to discover clauses that are the usual incident of the coverage applied for. When the insurer elects to issue a policy differing from what the insured requested and paid for, there is clearly a duty to advise the insured of the changes so made. The burden is not on the insured to read the policy to discover such changes, or not read it at his peril. In contrast, Hall did not apply for the specific type of insurance coverage he now claims that he expected as he asked in general terms for ‘soup to nuts’ coverage though a broad term that was not specific. Thus, Frederick could regard Hall’s application for insurance as seeking a general liability insurance policy.”

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|