|

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

|

|

|

|

| |

|

| |

The front door of Raoul Felder’s Madison Avenue law office has the word “push” written in nine languages. That still wasn’t enough help. I pulled. I’m not even in the waiting room and already the most famous divorce lawyer in America is speaking to me.

Of course, that Raoul Felder is A-number-one, top of the list, king of the hill of divorce lawyers is not something that can be proven as true. There is no Blue Ribbon panel put together by the ABA to bestow such title. But he is. The number of celebrity divorces (and other family matters) that Felder has handled in over 50 years is breathtaking. That, and the many prestigious national publications that have profiled him (GQ, Vanity Fair, The New Yorker, to name just a few) gives Felder the nod. But, for good measure, throw in the numerous law books that Felder has written – not to mention a few others with legendary comedian Jackie Mason. Felder is also the media’s go-to for commentary when a divorce is in the news. [I can’t find a national news program that hasn’t featured him, including 60 Minutes, 20/20, The Today Show.] |

|

|

|

But to define Raoul Felder, by only a checklist of accomplishments, is to say that Woodstock was a concert. You’d be right -- but. There is only so much about Felder than can be learned from his resume. The rest of him is a je ne sais quoi that can’t be captured by written words. Pulling, despite all the notices to push, is Raoul Lionel Felder’s way of saying welcome – my way.

I spent an hour with Raoul Felder. It is one that I will not soon forget. Nor my fifteen minutes on the phone with Jackie Mason – talking about the man -- that Felder kindly arranged. My conclusion: The lawyer most famous for divorce has one himself between what you think you know and what there is to know. |

| |

“Meeting” Raoul Felder

It is a jarring sight when you exit the elevator on the 36th floor at 437 Madison. The door to Felder’s law firm is glass. But it is flanked by two 1930s-esque faux doors. To the left is a door that leads to the office of Philip Marlowe, Private Detective. To the right is the door to Sam Spade, Criminal Investigations. I’m still in the hallway and my education has begun.

When you finally get inside, the nostalgia, and Felder’s unspoken welcome continues. A table in the small waiting room is covered with several copies of Time – from the late 1930s. Across from the old magazines is a tall, antique carnival game. It’s called “The Love Tester.” Drop a dime in the slot and “Measure Your Sex Appeal On This Love Meter.” More periodicals abound. But these are more current -- the walls are covered with newspaper and magazine articles about Felder. The selection rivals a Hudson News. There is a happy framer in the neighborhood.

I am escorted back to Felder’s corner office. It could have a jogging track. He is finishing up a meeting and points me to a chair. I take a seat and wait. His office is a sea of stuff – a combination of nick-nacks as well as objects that are no doubt very expensive. But there is no question that, while their value may differ widely, these things all share one thing in common – a great story about how they ended up there. |

|

|

|

My attention is immediately drawn to the candy dish put out for visitors -- M&Ms, but not the kind they sell at Walgreens. On one side of the candies are the initials RLF. On the other is a picture of Felder. I can’t help but smile. He still hasn’t said a word to me, yet he’s told me so much. But the funny artwork stops there. Behind me there is a Picasso hanging on the wall.

I take note that I’m already acquainted with my chair. In Reflections in a Mirror, Felder’s 2012 memoir, he eloquently described the chair that faces his desk: “The strumpet chair welcomed with indifferent embrace the grifters, the greedy, the confused, has-beens, wannabes, the victims, the scared who had good reason to be scared—and of those even some who ended up murdered—the women frightened of losing Park Avenue apartments or Hampton homes—death by real estate—and those who were simply frightened of life itself: the beaten, battered, pampered, lied to, deceived; the purveyors of rehearsed, overtold stories, told so often that the self-deceiver becomes a true believer; the seducers, the angry, the hate filled and the seekers of reparations for all the wrongs and inequities visited upon them like Ahab heaping upon a whale’s hump, ‘All the hatred and rage that had been in his race since Adam down.’”

Felder finishes up his meeting, we exchange pleasantries and the man known for being a clothes-thoroughbred doesn’t disappoint. His shirt, jacket, tie and pocket square and perfectly coordinated and the tailoring impeccable. I later ask him to pull his jacket aside so I can see the monogram on his shirt -- “sly fox.” Felder in fact pays me a compliment on my suit. I express my appreciation. But since it has been reported that Felder owns 350 suits, I chuckled and provided the obvious comeback – I guess you have it.

I am immediately struck by how soft-spoken the 76 year old Felder is. And as the hour went on, the lawyer whose trademark is aggressive advocacy (“[I]t is the lawyer's function, using all ethical, legal and moral means, to bring his adversary to his knees as fast as possible.”) was speaking to me in a whisper. This from the guy who once had a piranha in his office and fed it during tense negotiations. At several points I am panicky, convinced that there is no way that my $30 tape recorder on Felder’s desk could possibly be picking up a word he’s saying.

But that’s not the only you-can’t-judge-a-book-by-its-cover aspect of Raoul Felder. Felder’s life has revolved around celebrities and he is undeniably one himself. But, despite all the expectations and obligations that that would seem to create, Felder says in his memoir that he feels “uneasy at parties,” adding that, “as the party progresses, an empty closet begins to have an unnatural attraction for me.” Felder’s trick for getting away unnoticed – not coming with a coat. When I express my surprise about this he tells me he sometimes feels uncomfortable speaking to strangers. [Although that didn’t stop him from once walking up to newlyweds, who were taking pictures outside Radio City, and handing them his card.] |

| |

| |

The Client List

Talk is, as they say, inexpensive. So here I’ll back up the claim that Raoul Felder’s family law practice is, well, impressive. Felder has reportedly handled cases involving (not necessarily representing) Martin Scorsese, Johnny Carson, Rudy Giuliani, Joseph Heller, Peter O’Toole, Carl Sagan, Tom Jones, Lawrence Taylor, Frank Gifford, Brian DePalma, Al Roker, Mike Tyson, Mark Gastineau, David Merrick, Liza Minelli, Elizabeth Taylor, Johnnie Cochran, Carol Channing, Richard Harris, Patrick Ewing, Riddick Bowe, Tom Clancy and Mick Jagger. There are still lots more – but at some point a list has to stop. Not to mention that there are no doubt others that have not been made public.

Felder represents more wives than husbands. He attributes this to a simple consequence of opportunity, as explained in a published interview: “When men leave their wives, they tend to get recommendations for divorce lawyers from their colleagues. Women, especially women married to rich men, often don’t have a network of professional contacts. So they turn to me.” Many of Felder’s clients are repeat customers. The record is a tie between two women – seven times. I jokingly ask him if he has a frequent client club – nine divorces and the tenth one is free.

That Felder is a celebrity divorce lawyer should come as no surprise. After all, the first divorce he handled was for a celebrity client. Felder’s brother, Jerome, was Doc Pomus, the Rock and Roll Hall of Fame songwriter, who, together with Mort Shuman, wrote the words and music to hundreds of songs, including “Save The Last Dance For Me,” “This Magic Moment” and “Viva Las Vegas.”

Felder represented Shuman in his divorce. Mid-trial, Felder devised a way to determine that Shuman’s wife was having an affair with her husband’s best man. Without knowing if the best man had or hadn’t, Felder had Shuman call and tell his friend that he knew about the affair, but the friendship was more important. It worked. The best man came clean. The Daily News, covering the trial, reported the affair the next day. After that Felder’s phone began to ring. The rest is, well, you know. |

| |

A Career Built On Necessity

Some people’s explanations, of why they made certain significant life decisions, are expressed in terms of a big master plan that had been devised. For Raoul Felder, it was much simpler.

For sure he didn’t always dream of being a lawyer. Much to the contrary, law school was preceded by a stint in medical school in Switzerland. But as Felder described the experience in Reflections, “[d]ays went by, aimlessly, without purpose or commitment and toward no goal that I wanted to achieve.” The decision was made to come home to Brooklyn. He says it wasn’t defeat or embarrassment that bothered him, but, rather, the life that “stretched before [him]:” “I pictured myself striving for mean little things, surviving in an apartment facing a brick wall of an alley in Williamsburg, working at a second-rate job married to a second-rate wife who hung laundry on a clothes line. I saw myself groveling to bosses during the week and then, in summer, spending my spare time on public beaches after sweaty subway rides, or evenings sitting on the steps of a tenement, exchanging banalities with neighbors. I saw myself having little pride in my children to whom I could impart little culture or knowledge as I struggled to exist from paycheck to paycheck to meet my bills. My dreams would be limited to what I could see at the movies at the Rainbow Theatre on Graham Avenue.”

So “with no particular enthusiasm other than preventing [himself] from ending up on life’s scrapheap, a prospect that was becoming increasingly likely,” Felder enrolled at NYU Law School. Perhaps Felder’s experience, with dissecting a human body, has something to do with his talents as a divorce lawyer.

Felder’s desire to avoid a life of drudgery sent him to NYU Law. It likewise played a part in his decision to pack his bags at the U.S. Attorney’s Office after a few years. He explains in Reflections: “Trapped, sitting behind a government-issue desk in a government- issue chair, reviewing government-spawned papers was, to me, a one-way ticket on a treadmill to oblivion. … I waited and waited for my merry-go-round to take me to within snatching distance of the ersatz ring of gold while doing the sovereign’s work and taking the king’s shilling until opportunity entered my life in the form of the angry ring of a telephone that tore me from my sleep in the early morning hours, eventually transporting me to—at the time—the pantheon of the divorce gods: page three of the Daily News[.]” That phone call was from Mort Shuman. |

| |

Taking The Romance Out Of Divorce

Felder has been practicing matrimonial law long enough to have seen its development. Back in the day, when the only ground for divorce was adultery, the practice had a gum shoe component – raiding love nests with cameras in hand. But times changed. The advent of more grounds for divorce and no-fault divorce and equitable distribution has made the divorce business “terribly boring,” Felder says in one published interview. “They’ve taken the romance out of it now with this influx of new laws[.] It’s an accountant’s game.” Divorce law may be an accountant’s game, and perhaps the days of staking out motels are over, but Felder still seems to have fun with it.

I think of hiring Raoul Felder for a divorce case as good news – bad news. Bad news: your marriage is over. Good news: you have enough money to hire Raoul Felder. It is widely reported that Felder turns down lots of prospective clients. So who gets to sit near the M&Ms seems the logical opening question.

It has to do with personalities Felder tells me -- some people you just don’t want to work with. And, of course, some people can’t afford him. He will not represent a husband who has beaten his wife and he turns down cases involving child abuse. They take too much out of you, Felder tells me, adding that it’s also not healthy for a client to have a lawyer who has contempt for him. Felder points out that clients are replaceable. For this reason, he says, he has a “better racket than a judge.” “A judge is stuck with somebody,” Felder observes.

But sometimes the tables are turned and prospective clients don’t want to hire Felder – but they visit his office, pretending to, with the objective of later conflicting him out from representing their spouse. This happens many times Felder tells me. I’m amazed at the blatant unfairness of it. Is there a way to stop it?, I ask. Yes, Felder tells me, don’t be successful. He laments the problem but says that the alternative is worse.

I tell Felder that the insurance law business is open to all personalities. But surely divorce law isn’t for everyone. So what are the required traits I wonder. Felder doesn’t hesitate in his answer. You can’t be judgmental and must take people as they come, he tells me. Felder points to a sign on his desk with a Philip Marlowe quote: “Everybody has something to conceal.”

Of course I have to ask Felder about what is surely a hot topic in divorce law circles these days: same sex divorce. I had read Felder’s views on the subject before coming in. In published interviews he has said that, in his experience, same sex divorces are more contentious than heterosexual divorces. Same sex couples, he says, fought so hard for the right to get married. So when it doesn’t work out they are angrier. This societal institution failed them and now they are looking for a remedy to the injustice. He confirms all of this and tells me that they feel that they have been “double-crossed.” |

| |

Schmucks! and Speaking To Jackie Mason

Felder is a prolific writer – eleven books and scores of articles and editorials for national and New York-elite publications. A book of short stories (non-legal) is scheduled to be published in June he tells me. While most of Felder’s books are on the subject of divorce -- including his constantly updated Encyclopedia of Matrimonial Clauses – a few are a world away from the subject. Felder and his great friend, legendary comedian Jackie Mason, have collaborated on Jackie Mason and Raoul Felder’s Survival Guide to New York; Jackie Mason and Raoul Felder’s Guide to New York and Los Angeles Restaurants; Jackie Mason and Raoul Felder’s Guide to Chicago, Miami and Washington Restaurants and Schmucks! You can probably guess what that last one is about. But the sub-title will save you the trouble: “Our Favorite Fakes, Frauds, Lowlifes, and Liars.”

Schmucks! devotes one or two or three pages to numerous people who Felder and Mason believe are deserving of that label. I have the latest – the 2008 Bonus Schmuck Edition (with fifteen new schmucks revealed and reviled). To be sure, Felder, Chairman of the State Commission on Judicial Conduct when the book was released, took a lot of heat for it. Some saw things in the book as offensive and the Commission issued a vote of no confidence in him. Felder vigorously defended the allegations. He didn’t back down. But his critics did. |

|

|

|

Incredibly, there is an insurance entry in the book. And coverage no less! Felder and Mason take on World Trade Center owner Larry Silverstein for his “shameless” campaign to increase the insurance payment on a two events theory. The authors say that this is like arguing that “God handed down five Commandments – twice.” [Page 28 if you want to use that in a “number of occurrences” brief.]

One seeming challenge to writing Schmucks! is that, just like Felder’s Encyclopedia of Matrimonial Clauses, it is in constant need of updating. While of course there are always opportunities for new entrants, a perusal of the table of contents reveals that the book withstands the test of time. I ask Felder about this. He takes pride in how prescient he and Mason were in one particular case. Schmucks! devotes a vignette to a man who spent $10 million on his daughter’s bat mitzvah. Well after the book was published, the guy (a supplier of body armor to the military) was found guilty of insider trading, fraud, lying to auditors, and obstruction of justice in a $200 million case and sentenced to seventeen years in prison. According to the FBI, he used the money to finance an extravagant lifestyle, including an armor-plated luxury car, plastic surgery and a $100,000 belt buckle.

I ask Felder if he can arrange for me to speak with his dear friend and co-author. He says he’ll set it up. Lo, and behold, three days later Jackie Mason is on the other end of my phone.

A profile of Felder in one national magazine says that he and Mason met by chance outside the Carnegie Deli. I’m dubious. It’s one thing for two funny Jewish guys to co-write a book called Schmucks! But for them to have met, by chance, outside the Carnegie, just sounds contrived. The narrative is too perfect. I ask Mason if this is true. He tells me he can’t remember how he and Felder met because it’s been so long. But he’s sure it wasn’t outside the Carnegie Deli because that he would have remembered.

I mention to Mason my surprise that, despite all the expectations to the contrary, Felder is an introverted person. Mason agreed wholeheartedly, telling me that Felder “is not particularly much of a mixer with strangers” and avoids situations involving groups that require you to introduce yourself. However, Mason is quick to add that Felder is “remarkably humble” and exceptionally friendly and solicitous when people approach him and want to speak. “Just because he doesn’t enjoy all kinds of strange situations doesn’t mean that one-on-one he’s ever pretentious or arrogant.”

I tell Mason that I have tickets to see him perform at The Keswick Theater in Philadelphia in May. There is a pause. Mason is thinking. He tells me that he forgot all about it. We both laugh. |

| |

Raoul Felder: What You Think You Know And What There Is To Know

In so many ways, Raoul Felder is a contradiction in terms. The man who has spent a half century, mired in divorce, has been married to the same woman for a half century (herself a divorce lawyer). [Felder says he doesn’t argue with his wife. “I’m paid to argue. Why should I give it away for free?”] The man whose life has revolved around people who keep the cocktail napkin business afloat has a plan to escape parties. The man with the piranha speaks to me in a whisper. Ten feet away from his kitschy M&Ms hangs a Picasso. When he speaks he is a zinger machine. But the humor in his memoir is so subtle, that when you get it, you laugh even harder.

But Felder saves his biggest contradiction for that which he is best known – his public persona. To be sure, he is a publicity machine, the power of a GE turbine. And lots of media stories over the years are fond of describing his wealth – several luxurious apartments in New York, homes in the Hamptons and Palm Beach and a chauffeured-driven Rolls. What, of all this, he currently owns is none of my business -- so I don’t ask him to confirm the current status of his holdings. But suffice to say, he’s a wealthy man. However, for a rich and famous guy, with a couple of vacation homes, and the rest of the world a snap of the fingers away, I sense that he’s happiest in the solitude of his Madison Avenue office – pursuing his passion for writing. I ask Felder about retirement. It’s not in his genes he tells me. That’s good news for the unhappy glitterati, and miserable well-healed, who need the best that money can buy for saying au revoir.

As I’m leaving Felder’s office, and saying my goodbyes, I remark: “It’s been a life well-lived, sir.” Felder senses a fatalism in my comment: “Well, it’s not over yet,” he corrects me. |

| |

| |

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

Husband Sues Wife Over Valentine’s Day Present |

|

|

|

|

| |

This is an insanely crazy case. But, at its core, it involves an interesting coverage issue. It is just the kind of case that was made for the “Open Mic” column. It was decided several months ago – but I held it for this issue.

Roger and Sharon Buckley were husband and wife. Roger bought Sharon a “gold dipped rose” for Valentine’s Day. This is a real rose that has been preserved and trimmed with 24 karat gold. It is made to last forever. Sharon was not impressed with her husband’s purchase. She took to Facebook to declare it “the tackiest thing I have ever seen.” Sharon then added to her FB post: “I think Roger has a girlfriend, he gave her this hideous thing and she gave it back. It must not be returnable so now it’s mine.”

Shortly after Valentine’s Day the Buckleys’ marriage broke up. Sharon filed for divorce. It proceeded quickly and was finalized eight months later. But that wasn’t the last time that the Buckleys would find themselves in a courthouse. Roger learned about Sharon’s Facebook post stating that the gold dipped rose was originally intended for his girlfriend. Roger did not in fact have a girlfriend. The rose had been bought for Sharon. Roger believed that Sharon’s Facebook post was a libelous statement that he had engaged in infidelity. In Roger Buckley v. Sharon Buckley, No. 14-0643, Iowa District Court, Linn County, Roger sued Sharon for defamation and intentional and negligent infliction of emotional distress.

Sharon sought coverage for Roger’s defamation suit from her homeowner’s insurer – Hawkeye Property Casualty & Surety Insurance Company. There was no doubt that the defamation suit triggered the insuring agreement, under the liability section of the homeowner’s policy, as an “oral or written publication, in any manner, of material that libels or slanders a person.” However, Hawkeye P&C disclaimed coverage for the suit on the basis of the “Insured vs. Insured” exclusion. Sharon had no means to defend Roger’s suit or challenge the disclaimer. Roger’s lawyer worked with Sharon to reach a $95,000 settlement, assignment of her policy rights to Roger and a covenant not to execute on Sharon’s assets. Roger filed suit against Hawkeye P&C seeking coverage for the settlement.

Hawkeye filed a Motion for Summary Judgment on the Insured vs. Insured exclusion. As Hawkeye saw it, it was a simple matter. At the time of Sharon’s allegedly defamatory Facebook post, Roger and Sharon Buckley were Named Insureds on the homeowner’s policy. Therefore, the defamation action was clearly filed by one Insured against another Insured.

However, to the court in Roger Buckley, as Assignee of Sharon Buckley v. Hawkeye Property Casualty & Surety Insurance Company, No. 15-2657, Iowa District Court, Linn County (Oct. 28 2015), it wasn’t so simple. The court held that the Insured vs. Insured exclusion was not applicable. While it’s true that Sharon and Roger Buckley were both Insureds at the time of the allegedly defamatory statement, Roger was no longer an Insured at the time that he filed suit against Sharon. By that point, Sharon was living alone in the former marital home and the policy was now issued only to her. On that basis, the court held that the Insured vs. Insured exclusion did not apply. As for the $95,000 settlement, the court intimated that it agreed with Hawkeye P&C that it was excessive. However, having disclaimed coverage for a defense for the suit, the court stated that Hawkeye was not in a position to challenge the amount of the settlement.

Seemingly given the nature of the case the court couldn’t help itself from closing with a poem:

Roses are red;

But sometimes they’re gold;

If you don’t like this kind;

Your tongue you should hold;

Always remember;

It’s the thought that counts;

Don’t complain on Facebook;

Or lawyers will pounce.

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

The Greatest Song Ever About Lawyers And Love

|

|

|

When it comes to great songs about lawyers and love, you would think that Jackson Browne’s classic, “Lawyers in Love,” gets top honors. Well, think again. The song, in fact, has nothing to do with lawyers. At least not as far as I can tell. Check out the lyrics. If you see something I’m missing, please let me know.

[I reached out to Jackson Browne’s manager, Cree Miller, requesting to speak to Jackson, to ask him what “Lawyers in Love” has to do with lawyers. She replied that he is not available while on his solo tour. Come to think of it, a doctor, in "Doctor My Eyes", seems an unusual choice to lament one's hardships. Jeez, what’s up with this guy?]

But there is a great song that is unquestionably about a lawyer (and a Philadelphia one at that) and love. Check out these wonderful lyrics of Woodie Guthrie’s 1937 “Reno Blues:”

Way out in Reno, Nevada

Where romance blooms and fades

A great Philadelphia lawyer

Was in love with a Hollywood maid.

“Come, love, and we will wander

Down where the lights are bright

I'll win you a divorce from your husband

And we can get married tonight.”

Wild Bill was a gun-totin’ cowboy

Ten notches were carved in his gun

An’ all the boys around Reno

Left Wild Bill’s maiden alone.

One night when he was returning

From ridin’ the range in the cold

He dreamed of his Hollywood sweetheart

Her love was as lasting as gold.

As he grew near her window

A shadow he saw on the shade

‘Twas the great Philadelphia lawyer

Makin’ love to Bill’s Hollywood maid.

The night was as still as the desert

And the moon hangin’ high overhead

Bill listened a while to the lawyer

He could hear ev’ry word that they said...

“Your hands are so pretty and lovely

Your form’s so rare and divine

Come go with me to the city

And leave this wild cowboy behind.”

Now back in old Pennsylvania

Among the beautiful pines

There’s one less Philadelphia lawyer

In old Philadelphia tonight...

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

How Do I Love Coverage?:

Some Of The Nation’s Leading Coverage Lawyers Count The Ways

|

|

|

I love being an insurance coverage lawyer. And I have long observed that many of the coverage lawyers that I know also love doing what they do. Not just like doing it. But love doing it. But why? I know why I do. But what about the others? Since this is the Valentine’s Day Issue of Coverage Opinions it seemed like the perfect time to reach out to some of the nation’s leading coverage lawyers and ask them this simple question: Why do you love being an insurance coverage lawyer? I appreciate my colleagues sharing their reasons.

***

I love insurance coverage because it is a riddle wrapped in a mystery inside an enigma. Some companies have literally hundreds of millions of dollars sitting in a filing cabinet. I love helping my clients realize those assets to address the myriad liabilities and challenges presented by a dynamic landscape of extraordinary, changing, and emerging risks, including cyber risk. I am delighted to have the privilege to do so on behalf of my clients without exclusions, limitations or conditions! And, of course, I love reading Coverage Opinions. A very Happy Valentine’s Day to my insurance industry friends and colleagues.

Roberta Anderson

K&L Gates, LLP

Pittsburgh

I love being a coverage attorney for many reasons. It’s exciting and energizing. Seriously, every day, I come to work and think about the insurance issues and projects that I hope I have the opportunity to tackle. It’s intellectually stimulating; the work is timely and topical. Today’s news headline is tomorrow’s insurance assignment. I like to problem-solve and it’s rewarding to feel that you are helping clients tackle important issues – sometimes even cutting-edge issues for the insurance industry. And I often work in coalition settings for insurers and insurance trade groups, so I get to work with great people, too – clients and other insurance industry professionals, and peers who are excellent coverage counsel all across the country.

Laura A. Foggan

Wiley Rein LLP

Washington

Like most coverage and bad faith attorneys I suspect, analyzing and litigating the meaning of insurance policy language was not a career I pursued from childhood. Famed criminal lawyer Perry Mason was not my inspiration, nor did I find my contracts and insurance law classes particularly exhilarating. Nevertheless, as a young lawyer in the early 1980s, I was taken by the burgeoning CERCLA environmental landscape, and corporate insureds’ (before they decided to call themselves “policyholders”) attempts to obtain coverage despite the plain language of general liability policies’ “occurrence” requirement and the “sudden and accidental” pollution exclusion. The stakes were high, the lawyers excellent, and the litigation prolific. With a few victories in hand, my passion for representing the insurance industry in coverage matters ensued. Thus rings true Professor Cal Newport’s book, “So Good They Can’t Ignore You: Why Skills Trump Passion in the Quest for Work You Love,” suggesting one’s career passion actually is the natural result of work well done, rather than an initial mindset which leads to fulfillment. Times may be a changin’, however. Tom Hanks’s riveting portrayal of noted insurance lawyer James Donovan in Bridge of Spies, no doubt, is bound to spawn a generation of aspiring coverage lawyers. Hollywood has taken notice. We have arrived!

Mike Marick

Hinshaw & Culbertson LLP

Chicago

I would like to offer two observations made over the past 30 years of insurance practice. First, lawyers on both sides of the aisle have shown remarkable (legitimate and appropriate) creativity and ingenuity in the interpretation and application (or non-application, as the case may be) of insurance contracts to the facts at hand. This has led to an almost constant state of evolution in insurance law, and it has made the practice dynamic and always interesting. Second, I have observed a remarkable degree of collegiality and civility among the members of the insurance bar. We encounter each other with frequency, and our relationships exhibit a level of respect that other practices would do well to emulate. Many friendships have been formed between lawyers from opposite sides of the aisle, and this I believe is atypical in a litigation intensive environment such as ours.

Jack Montgomery

Jones Day

Pittsburgh

Being a coverage lawyer provides a unique way to interact lovingly with my five grandkids, who range from five to twelve years of age. The kids recently attended my 50th wedding anniversary party and learned that Sandy and I had spent more than 50 Valentine’s Days together. We had known each other for two years prior to our wedding. . . but the grandkids have no concept of how long fifty years really is. They do sort of know that their Babu (that’s me) is a “famous” lawyer, but when one of them asked me if I was practicing law when Lincoln was President (or 251 Valentine’s Days ago), I told him no, but that I did remember Roosevelt. He thought for a moment and asked “Teddy or Franklin?” I was born in 1942, so that would be Franklin and now that I’m 73 (almost 74), that would be just as many Valentine’s Days ago! For me, my love of the law extends its web through our entire family and the law is at the center of this universe of love that I call my descendants, my brood, my offspring, my heart, even if they cannot accurately compute Valentine’s Days.

Jerry Oshinsky

Kasowitz Benson Torres & Friedman LLP

Los Angeles

I love being a coverage lawyer because it often calls for immersion in the amorphous beauty of the written word. Nothing gets the blood flowing like a high-stakes duel with a worthy adversary about verb tense or the placement of a comma. And finding a decision where a like-minded judge devotes four pages to the meaning of a single word can make a coverage lawyer’s heart pound and cheeks flush. Ahh, now that’s bliss!

Julianna Ryan

Kaufman Borgeest & Ryan LLP

New York City

The Valentine’s Day question, “Why do you love being an insurance coverage lawyer?” may bring new meaning to the word “love-sick;” non-coverage lawyers can be excused for thinking that anyone who has a “thing” for insurance needs psychiatric or, perhaps, pharmacological help. My affair with insurance coverage began as something of a blind date. My first job following a judicial clerkship, 27 years ago, was with the firm then known as Anderson, Kill, Olick & Oshinsky. During my first day walk-around to meet my new colleagues, I was introduced to a mid-level attorney who said: “I need some help on a big piece of environmental coverage litigation. Come back and see me this afternoon, if you’re interested.” I had no idea what he was talking about, of course. I soon learned the following five things about my new mistress (coverage law, that is; not the mid-level attorney): (1) with a bit of determination and persistence, a lawyer can become an insurance expert in a relatively short time; (2) insurance policies are like puzzles in which the shapes of the pieces change according to state law, making the solution to particular coverage problems endlessly intriguing; (3) most people never read their insurance policies and, even if they do, they find the documents hard to understand – which makes the coverage lawyer’s advice particularly valuable to a client; (4) many policyholders simply accept a carrier’s denial of coverage as “probably correct,” which makes a coverage lawyer a real hero when he or she finds money that the policyholder had never actually expected to recover; and (5) as long as insurance companies continue to sell policies they will continue to deny claims – which means that a coverage attorney need never have a fear of running out of work. So call me love-sick. I won’t deny it.

Carl A. Salisbury

Bramnick Rodriguez Grabas & Woodruff

Scotch Plains, New Jersey

I love being a coverage lawyer because of the nature and sophistication of the work and the relationships I have with clients and, indeed, adversaries. For me personally, the added bonus is that no two coverage matters are precisely the same, there is seldom a dull moment, and the coverage questions often hinge on complex issues in high-stakes lawsuits against the insureds. My opposing counsel is almost always sharp and experienced, we tend to know each other well, and we usually get along. Standing with me are clients that have proven loyal even when I left a large firm after some 18 years. In fact, the only major, long-term distinction between client and spouse is that one considers you to be an expert in something very important while the other still expects you to take the trash out.

Ron Schiller

Hangley Aronchick Segal Pudlin & Schiller

Philadelphia

My love for coverage emanates from these 3 words -- CREATIVITY - VISIBILITY - PERSISTENCE. All of which also apply to the love of life!

Tom Segalla

Goldberg Segalla

Buffalo

I love the intellectual puzzles that coverage presents, perhaps best summed up by this traditional Valentine poem:

Roses are read,

Policy’s not.

I often say

You get what you bought.

Might not be true

That cup is half full.

Are your expectations

Reason or bull?

Neil Selman

Selman Breitman LLP

Los Angeles

Before I could explain why I love being a coverage lawyer I had to admit to myself that I do love being a coverage lawyer. And I do! As for the why, at first I came up with all the usual reasons. The work is interesting. It fits the way I think. The pay is reasonably good. The stakes tend to be high, so there’s a level of excitement associated with it. Most clients treat you as a valued member of a team and not as just another service provider. On and on. But what I really love about it is that it is a rare practice that allows you to regularly ply your trade outside the borders of your home jurisdiction. Because of that I have had opportunities to meet so many interesting people, in all parts of the country, that I otherwise would not have met. Many of them have become life-long friends. Life’s not about the work. It’s about the people you meet along the way. Plus, how else would I have met, and be able to call friend, a world-class coverage lawyer from Philly who is even better doing stand-up under a pseudonym in the clubs of New York?

Chuck Spevacek

Meagher & Geer, P.L.L.P.

Minneapolis

|

|

| |

|

|

|

| |

|

Vol. 5, Iss. 2

February 10, 2016

Every Day Is Valentine’s Day For These Insurance Folks

|

|

|

I’ve done a couple of articles in the past demonstrating that, even on holidays known for rest, relaxation and family time, insurance coverage takes no breaks.

For example, when it comes to coverage, there are no turkey-induced naps to be had on the fourth Thursday in November. Certainly the folks in Jenkins v. Mayflower Insurance Exchange (Ariz. 1963), State Insurance Fund v. David A. Gobble (Ok. 1988) and Hodgate v. Pilgrim Insurance Company (Conn. Super. Ct. 2013) know this.

But surely insurance coverage can get some time off on Christmas, right? No Siree Bob. Here too coverage cannot be cast aside for the annual NBA marathon and a crudite platter with your cousins. Even on the one day a year when nothing is open except the Rite-Aid near my house, the insurance coverage beat marches on. The guys in Hernan Santa v. Capitol Specialty Insurance (N.Y. App. Div. 2012), Barbara Christmas v. Nationwide Mutual Insurance (E.D.N.C. 2014) and Rebecca Rudolph v. Standard Insurance Co. (W.D. Wash. 2012) can certainly attest to this.

I thought about doing a similar thing for Valentine’s Day. And, in fact, it would not have been very difficult. There’s Lexington Insurance Co. v. Nigel Cupid (D.V.I. 2007), Christy Valentine v. State Farm (D. Nev. 2015), Massachusetts Bonding and Insurance Co. v. Chocolate Man, Inc. (N.Y. App. Div. 1959) and so, so many more.

However, I gotta say, I think I’ve beat this idea to death. So, instead, here is a different take on it. Look at these insurance professionals who see Valentines every day of the year.

Valentine Insurance Agency

Elgin, Illinois

valentineinsurance.net

Valentine Insurance Agency

Moberly, Missouri

valentineinsagency.com

Valentine Insurance Agency

Manteca, California

valentineinsurance.com

Valentine Insurance Agency

Denedin, Florida

viafla.com

Valentine Insurance Agency

Catskill, New York

myvalentineinsurance.com

The Valentine Agency

Mineola, New York

thevalentineagency.com

Valentine Insurance

Denton, North Carolina

valentinenc.com

Valentine Insurance Agency

Cambridge, Ohio

valentineinsuranceagency.com

Valentine Insurance Services

Loves Park, Illinois

valentineinsuranceservices.com

Something tells me these guys may not all love each other.

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

50 Ways To Leave No Cover: An Insurance Coverage Love Song

|

|

|

It just wouldn’t be Valentine’s Day if I didn’t include one of my favorite Coverage Opinions’s pieces. This ditty originally appeared in the February 13, 2013 issue of CO:

Happy Valentine’s Day. Guys, if you have not yet bought a gift you are getting really close to the point of having to stop at CVS for a Whitman’s Sampler and a card that has been rejected as not good enough by 412 people. Not to mention that it no longer has a single sharp corner or an envelope that fits. Boys, take it from experience, this is not the way you want to go.

With Valentine’s Day tomorrow it only seemed appropriate to use this Cover-age Story to share a love song. Paul Simon briefly attended Brooklyn Law School (it’s true – lots of websites say so). Imagine if he had finished and then went the insurance coverage route. It would have only been a matter of time before someone with those songwriting skills, who spent his days cranking out disclaimer and reservation of rights letters, would have come up with this beautiful tune.

50 Ways To Leave No Cover

The problem is all inside your head she said to me

People paid for a liability policy

And now your desk has paper in piles

And people screaming about upcoming trials

The answer is easy if you take it logically

Just close those files and set yourself free

I’d like to help you in your struggle

With those large loss reports that you must juggle

There must be fifty ways

To leave no cover

Your notice was late Kate

And then you didn’t cooperate

That’s not an occurrence Terrence

It’s impaired property Lee

You furnished alcohol Paul

You intended that Matt

We’re just excess Bess

We reserved on Buss Gus

Your claim relates back Jack

You spilled pollution Lucien

It’s a four corners state mate

That’s not PD Bea

The plaintiff’s your employee Dee

You’re just not an AI Ty

You never gave notice Otis

Your payment was voluntary Jerry

An insured, a dog is not, Spot

You had knowledge of falsity Leigh

We just never intended to cover that Pat

You prejudiced us Russ

That relief’s only declaratory Lori

You’re not legally obligated to pay Jay

That’s not trade dress Les

There’s misrep. in your app. Kap

We defended but we don’t have to indemnify Guy

We’ll just investigate Nate

Your claim’s not first made Wade

There’s other insurance Vince

You’ve got an uninsured share Claire

The damage is your own work Kirk

Wrong policy term Thurm

We forgot to reserve but we still didn’t waive Dave

It’s TCPA Faye

Or call it a junk fax Max

It’s not an accident Kent

We don’t cover an assault Walt

We lost your file Kyle

And your file too Lou

Your watercraft’s not less than 26 feet Pete

Emotional injury is not BI Di

That’s not a professional service Gervase

I just ignored my boss Ross

We don’t cover recall Saul

The policy is void Boyd

That’s mobile equipment Clint

That’s not a suit Newt

And for absolutely no reason at all, your claim’s denied Clyde

There must be fifty ways

To leave no cover

A tribute to Paul Simon’s classic “50 Ways to Leave Your Lover” may seem an odd choice for celebrating Valentine’s Day. But despite a title suggesting otherwise, it is a love song. After all, the song is about a woman providing advice to her lover, on ways that he can leave his wife or another woman. I mean, how’s that not a love song? That’s as romantic as anything Karen Carpenter ever belted out.

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

Suing Match.com: Looking For A Relationship – With Match’s Money

|

|

|

Match.com has faced dozens of law suits over the years in federal and state courts. They come in all shapes and sizes. Many of them involve business-related issues, such as patent infringement, consumer protection and intellectual property issues. In addition, Match has been sued when things went awry following introductions made through the site. Needless to say, when you are in the business of facilitating introductions, between strangers, for the purpose of forming relationships to varying degrees – including intimate -- the train is bound to go off the tracks. Having said that, despite this seeming recipe for trouble, I couldn’t locate too many instances where Match has been sued by one member for the conduct of another. No doubt Match does a good job of protecting itself from them.

But I found a few. I hate to be a Debbie Downer on Valentine’s Day, but here’s a brief description of some cases where Match.com members sought relief after using its service.

Gilbert Lau v. Match.com, United States District Court for the Southern District of New York, No. 13CV2938 (May 10, 2013): Plaintiff alleges that Match.com failed to prevent him from being scammed by various customers – allegedly to the tune of several hundred thousand dollars. Here’s just one of the scams that plaintiff Gilbert Lau says he fell for: “On July, 2011 I met by online and NOT in person defendant Mercer in defendant Match.com site. In three days she later says she is in Nigeria, for her father’s inheritance of $2,500,000.00. She says needed $85,000.00 of money for legal expense and personal expenses. Plaintiff did bank wired to defendant Mercer and plaintiff’s friends James Larkins and Marla Johns warned the plaintiff this is a scam because Nigeria is the scam capital country of the world. This happen in the internet date. The defendant Match.com did not have any security prevention to protect plaintiff as result plaintiff loss all his money and upon information and belief other customers both men and women are victim. Do to the failure of defendant Match.com Plaintiff loss total of $362,000.000 because Defendant Match.com willfully neglect Plaintiff loss total of $362,000.00 because of defendant Match.com conduct.” (sic). Complaint at para. 10. [Plaintiff voluntarily dismissed his action without prejudice on November 14, 2013.]

Mary Kay Beckman v. Match.com, United States District Court for the District of Nevada, No. 13CV97 (Jan. 18, 2013): Plaintiff alleges that she sustained life-threatening injuries after being stabbed by a man that she met on Match and with whom she had a ten day dating relationship. Plaintiff alleges that “[d]efendant Match has employed deceptive acts and/or practices directly affecting commerce by way of falsely advertising matchmaking services purporting to only facilitate happy and healthy relationships between its members. Complaint at para. 42. Plaintiff also alleges that “[d]efendant directly misled Plaintiff into believing that a subscription to Defendant’s services came with associated protections and safeguards that are absent in other internet based forums.” Complaint at para. 44.

The court granted Match.com’s Motion to Dismiss. Among other reasons: “Match.com asserts that plaintiff has failed to state a claim for her negligence claims because Match.com had no legal duty to prevent the brutal attack. Plaintiff responds that a special relationship has arisen because she was a ‘paying subscriber’ as alleged in the complaint. However, merely being a ‘paying subscriber’ is insufficient to establish a special relationship. Here, the brutal attack occurred offline several months after plaintiff and Ridley had ended their dating relationship that began by communicating over the website. The court finds that plaintiff’s factual allegations do not support her claim that a special relationship existed between herself and Match.com. Plaintiff cites no authority, and the court is aware of none, that supports her position that Nevada courts would find a special relationship between a provider of online dating services and subscribers. In fact, a district court has held that, under Texas law, a website operator’s relationship with a paying website subscriber is not special, but instead an ‘ordinary commercial contract relationship.’” Beckman v. Match.com, 2013 WL 2355512 at *8-9 (D.Nev. May 29, 2013). [Plaintiff appealed to the Ninth Circuit. The last entry on the Ninth Circuit docket – Court received seven paper copies of Plaintiff’s Reply Brief (4/14/14).]

In Doe v. Match.com, 789 F. Supp. 2d 1197 (C.D. Cal. May 25, 2011), the Plaintiff alleged that she used Match.com to meet another subscriber -- who was a serial sexual predator. Plaintiff alleged that this subscriber forcibly raped her, and that Match “could have instituted basic screening procedures to prevent her rape.” The court denied Plaintiff’s request for a TRO to prohibit Match “from signing up new members until an effective screening process is in place.”

Turing to the Plaintiff’s request for a permanent injunction, the court denied that as well, holding that Plaintiff “presented no evidence that she plans to use Defendant’s services to meet other users,” thus, “diminishing the possibility that she could suffer any injury caused by Defendant's failure to screen for sexual offenders.” Further, “[e]ven if Plaintiff’s own admissions suggesting that she plans to avoid Defendant’s services are ignored, Plaintiff has not shown that she has a greater likelihood of injury than any of Defendant’s other one million subscribers and millions of members nationwide.” Id. at 1200-01.

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

Does The Pollution Exclusion Apply To Kangaroo Dung?

General Liability Insurance Coverage -- Key Issues In Every State Goes International!

|

|

|

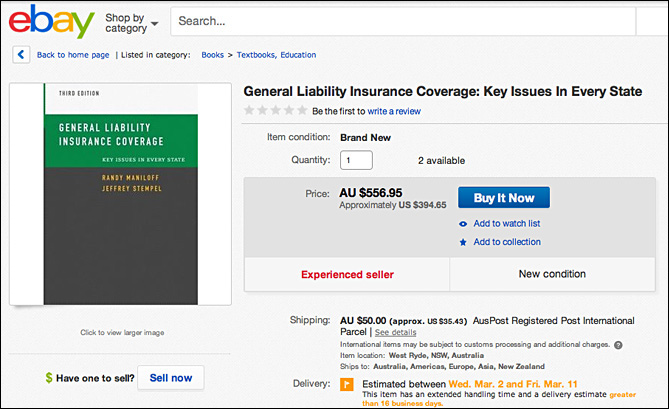

It was brought to my attention that the 3rd Edition of General Liability Insurance Coverage -- Key Issues in Every State is for sale on ebay. That’s kinda surprising. But wait! That’s not even the half of it? Get ready for this…the seller is in Australia. Australia! Can you say koala bite exclusion.

Somehow an Australian ebay seller, named Ausreseller, thinks that there’s a market in Australia for the 3rd Edition of Insurance Key Issues. Not to mention that the price is 556 Australia Dollars, which is close to 400 real dollars, i.e., three times the price that you can get the book for at the publisher’s website. Good luck mate.

Don’t go to Australia to buy the 3rd Edition of Insurance Key Issues.

Get it here www.createspace.com/5242805 and use Discount Code NTP238LF for a 50% discount.

I mentioned to my 9 year old daughter that it was exciting that Key Issues was for sale on ebay. She commented: “Why’s that exciting? It means that someone bought it, saw how boring it is, and now they’re trying to get rid of it.” Actually, I hate to say it. But she’s right.

See for yourself why so many find it useful to have, at their fingertips, a nearly 800-page book with just one single objective -- Providing the rule of law, clearly and in detail, in every state (and D.C.), on the liability coverage issues that matter most.

www.InsuranceKeyIssues.com

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

Insurance For Crossing The Street:

Guest Author Matt Haicken Addresses The Most Important Insurance Policy You’ve Never Heard Of -- The Named Non-Owner’s Auto Policy

|

|

|

Matthew Haicken

Haicken Law PLLC

haickenlaw.com

As a plaintiffs’ personal injury attorney, and former claims adjuster, I have analyzed accident litigation from just about every angle. I have seen too many cases where people were catastrophically injured in a car accident, and the at-fault driver didn’t have nearly enough insurance coverage. In New York, automobile owners are only required to carry $25,000 of liability insurance. Many cars in New York have just this amount.

On numerous occasions, I have had to break the news to clients, who had been severely hurt, that the most they could possibly receive was $25,000 for the lifetime of pain and suffering that surely awaited them.

Of course, the best way to protect oneself against this possibility is to have a large uninsured motorist/underinsured motorist coverage limit in your auto policy. The UM/SUM coverage covers you if you are in an accident with someone who is either uninsured, or who doesn’t carry enough insurance to compensate you for your injuries. In the event of such an accident, the insured, or resident relative of the insured, makes a first party claim against his or her own policy. (Generally, a resident relative of a named insured can make a claim for UM/SUM benefits.) The UM/SUM carrier then steps into the shoes of the uninsured or underinsured vehicle and litigates the case against the claimant. The claimant can either arbitrate, or file a lawsuit against the insurance company. Regardless of whether the full value of the policy is ultimately awarded, the claimant at least has the possibility of obtaining compensation, whereas, without such policy, no such chance would exist.

As a longtime Manhattan resident, who does not own a car, I had often lamented my inability to buy this essential protection. It seems that almost every day I am nearly run over in a crosswalk, and the cabs or Uber vehicles in which I often ride seem to cheat death at every turn. I have felt myself wishing I could own a car -- just to get a large UM/SUM limit. Then I learned about the most important insurance policy I had never heard of: The Named Non-Owner’s Auto Policy. This is car insurance for people who don’t own cars.

The insurance industry typically markets these policies only to people who frequently rent or borrow cars, have personal assets of their own, and don’t want to buy additional third party liability insurance each time a car is rented or borrowed. However, this type of policy is ideal for Manhattan residents, regardless of their personal assets, because of its built-in UM/SUM coverage. After doing extensive research, I found a carrier who wrote me a policy with a $2 million limit for a premium of only about $500 per year. This is for liability and UM/SUM. (I couldn’t find a carrier who would write more UM/SUM than liability and $2 million was the highest policy amount I could find).

For the seriously paranoid

Is $2 million enough to cover your injuries? For those of us who have been in this business long enough, we realize that $2 million may, in fact, not be enough to cover the damages from a serious accident. The solution? Umbrella coverage with an endorsement. Many people are under the mistaken impression that their umbrella policy covers UM/SUM. This is generally not true. A standard, unendorsed ISO form umbrella policy, does not cover UM/SUM. However, many carriers will permit an endorsement adding at least another $1 million layer of coverage specifically for UM/SUM. This is the best bet for those who are seriously worried about being seriously injured and getting seriously compensated.

If you don’t own a car, and don’t live in a household with someone who owns a car, you are taking your financial future in your hands every time you cross the street, ride in a car, or drive one. The only way to ensure you may be covered, in the event of an accident, is through the purchase of a named non-owner’s auto policy (preferably with an endorsed umbrella on top).

***

Matthew Haicken is the owner of Haicken Law PLLC where he focuses on personal injury, employment law, and the representation of restaurants before the New York State Liquor Authority. Before starting his own firm, he worked at a multi-national insurance company in both Complex Casualty Claims and Underwriting Operations. Prior to his insurance career, he spent nearly four years as a plaintiffs’ personal injury trial lawyer with two top New York City firms. In addition to his legal career, he is also an accomplished sleight of hand magician. While he is very excited about the discovery of the named non-owner’s auto policy, he sincerely hopes to never make a claim against his own.

The opinions and recommendations expressed in this article are solely those of the author.

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

Bill Barker Responds To Lee Archer’s Commentary On The “Modern View” That Insurers Must Initiate Settlement Negotiations – Even Without A Demand -- To Protect Insureds From Excess Judgments

|

|

|

The January 13th issue of Coverage Opinions featured a guest commentary by Lee Archer, appeal co-counsel in Kelly v. State Farm (La. 2015). In Kelly, the Louisiana Supreme Court held that an insurer can be found liable for a bad-faith failure-to-settle claim, under Louisiana’s version of the Unfair Claims Settlement Practices Act, notwithstanding that the insurer never received a firm settlement offer. Ms. Archer’s commentary advocated that the decision in Kelly wasn’t as shocking as some defense and coverage counsel for insurers have maintained. As Ms. Archer sees it, that an insurer can be liable for a bad-faith failure-to-settle claim, notwithstanding that the insurer never received a firm settlement offer, is already the “modern view” on this issue.

Bill Barker, of the Chicago office of Dentons US LLP, offers the following response to Ms. Archer’s commentary:

Insurers Ought Not To Be Required To Initiate Settlement Negotiations

By William T. Barker

In the last issue of Coverage Opinions, Lee Archer argued that “[t]he modern view is that absence of a third party’s settlement demand will not insulate a liability insurer from exposure to liability to pay sums beyond its policy limits as a result of its bad faith and unfair dealing in settlement..” Lee Archer, The Modern View: Insurers Owe a Duty to Initiate Settlement Negotiations to Protect Insureds from Excess Judgments, Coverage Opinions (Jan. 13, 2016), quoting DENNIS J. WALL, LITIGATING & PREVENTING INSURANCE BAD FAITH, § 3:14 (3rd ed. 2012). Space here is too limited to argue about the current state of the law, but I disagree with the rule Archer advocates.

To be sure, I recognize situations in which absence of a demand is not a defense. Thus, if the insurer has forestalled a demand by refusing to disclose the limits when it should have done so and has also failed to initiate settlement negotiations, the reasonableness of its actions may present a jury issue. E.g., Powell v. Prudential Prop. & Cas. Ins. Co., 584 So. 2d 12 (Fla. Dist. Ct. App. 1991). If the insurer has offered its limits but (without consulting the insured) refused to have the insured give a statement to determine whether there were other possible sources of recovery, the absence of a demand does not preclude a jury from finding the refusal to seek a statement unreasonable. E.g., Badillo v. Mid-Century Ins. Co., 2005 OK 48 (2005). But if the insurer has done nothing to obstruct a claimant’s consideration of a possible demand and has breached no other duty to the insured, I argue that it should not be liable for failure to settle unless it has refused a demand (or failed to tender its limits, if the demand exceeds limits).

This view is not limited to insurers and those who represent them. Dean Syverud has noted that some courts may think requiring the insurer to negotiate may be desirable, lest the insurer be able to manipulate the negotiations so the claimant never makes a demand. Kent D. Syverud, The Duty to Settle, 76 VA. L. REV. 1113, 1166–67 (1990). But he points out that such a requirement places insurers at the mercy of jury interpretations of the settlement strategies in particular cases and concludes that such a standard is likely to change bargaining strategies in all cases, not just those where settlement is appropriate, resulting in overpayment that will be “a cost to all insureds.” Id. at 1168.

My argument relies on a more focused examination of the effects of a rule requiring or not requiring a demand to find liability. Looked at purely based on the rule that the insurer should act as it would if it alone were liable for the entire judgment, it would seem reasonable to require the insurer to initiate negotiations if that is what any reasonable insurer would do if it alone were liable. But that fails to take account of the distortion of the claimant’s incentives resulting from the very existence of the duty to settle. While the law of bad faith is designed to provide insurers with incentives to address settlement in an appropriate manner, existence of that law alters the incentives of claimants in a way that can be harmful to insureds.

While creation of the settlement duty might not greatly affect the claimant if the policyholder could pay any excess judgment, it has a dramatic effect if the policyholder cannot do so. A greater amount would become recoverable if the insurer breached its duty than if the case were simply taken to a favorable judgment. The claimant thus acquires an incentive to exploit the existence of the duty.

If the expected value of the claim (without regard to collectibility) does not exceed limits by much, the claimant is most likely to use the duty to pressure the insurer to agree to pay the limit (or some smaller amount). If the insurer refuses, any judgment will become fully collectible. Still, the claimant is likely to be chiefly interested in settlement, just as would be the case with a sufficiently solvent tortfeasor.

But if the claim’s expected value is far greater than the policy limit, the injured party may instead seek to provide occasions for the insurer to bypass an arguable settlement opportunity. If the insurer breaches its settlement duty, the entire judgment will become collectible (though at the cost of a second lawsuit), and this may permit settlement for the full value of the case. Even a colorable argument that the duty has been breached will permit bargaining for some payment above the policy limit.

The first of these situations involves a claimant primarily seeking performance of the settlement duty, while the second primarily involves an effort to find a breach. After all, performance of the settlement duty involves no more than payment of policy limits, and those limits are assumed to be far below the value of the second claim.

The opportunity for injured parties to seek increased payment by inducing an insurer misstep (or arguable misstep) has created a new danger for impecunious policyholders. If there were no settlement duty, claimants would recognize that the policy limits would be all that they could hope for. They would have no incentive to pursue litigation against a judgment-proof (or nearly so) tortfeasor, once the policy limits had been offered. The settlement duty creates incentives that could subject impecunious insureds to large judgments only because the claimants were pursuing a bad faith recovery, instead of simply taking the policy limits.

Pointing this out is not a criticism of injured parties or their counsel. They respond as best they could to a situation involving inadequate resources to fully compensate the injuries at issue. One court has strongly rejected criticism of counsel who allegedly made unreasonable demands in a situation where there were multiple claimants and inadequate limits” “Safeco’s rhetorical complaint that the bad faith litigation was a setup engineered by Brindley was not successful with the jury, and as a legal argument it is … unsuccessful. Pressing for a policy limits settlement for a badly injured client is a professional responsibility, not a sinister plot. Keeping bad faith litigation in mind as plan B if the insurer balks is a fair practice. Safeco could have protected itself by putting the limits on the table for all three passengers.” [Miller v. Kenny, 325 P.3d 278, 297-98, at ¶ 85 (Wash. Ct. App. 2014).]

But the issue for a common-law court is whether it is desirable to adopt a rule of law that holds out the incentives which produce behavior designed to induce breaches, rather than compliance.

Those incentives harm impecunious policyholders, some of the very policyholders the settlement duty is designed to protect. They also harm the judicial system by generating litigation which would otherwise never be necessary.

For example, Gutierrez v. Yochim, 23 So. 3d 1221 (Fla. Dist. Ct. App. 2009), arose from an August 12, 2003 accident in which Gutierrez’s car struck Yochim’s motorcycle. Dairyland Insurance, Gutierrez’s insurer, immediately concluded that she was at fault, and advised her that her policy had a $10,000 bodily injury limit. On August 20, Dairyland obtained the police report, which described Yochim as having suffered “incapacitating” injuries. On August 18, a lawyer for Yochim contacted Dairyland, but ten days later said that Yochim had hired someone else, though asserting a lien for his own services. Having appraised the motorcycle, Dairyland paid its property damage limit in late August and notified Gutierrez that he might have liability for an excess judgment on either the property damage claim or for the potentially serious injuries to Gutierrez. On October 9, the new lawyer’s paralegal told Dairyland that Yochim might have sustained a significant spinal cord injury, and it requested medical records or an authorization to obtain them, stating that it wished to settle the claim as soon as possible. Id. at 1222-23. The lawyer apparently had the medical records, but sent only an authorization. Id. at 1225.

On February 1, 2004, shortly after obtaining the hospital records, Dairlyland sent a letter offering its policy limits, subject to placing the name of the first lawyer on the check or obtaining an agreement regarding the lien. Having received no response, it sent a similar letter a week later. The new lawyer responded a week later that he would be responsible for any lien and that he would discuss the matter with his client when and if the limits were “tendered.” The adjuster inquired what more he wanted in the form of a “tender” and that a check would be sent only if he indicated that it would be accepted in settlement; the lawyer responded that the adjuster should seek advice from his own counsel if he wanted it. On April 1, 2004, the adjuster hand delivered a check, which the lawyer refused. In his deposition, he claimed that he would have settled in February had the limits been tendered then. Id. at 1223-24.

After a stipulated judgment in the suit against Gutierrez, she sued Dairyland for bad faith, and Dairyland obtained a summary judgment. The court of appeals reversed, saying that Dairyland knew enough about the severity of the injuries that it could not be said, as a matter of law that it did not have a duty to offer the policy limits earlier. Delay by Yochim’s lawyer did not matter, because Dairyland’s “fiduciary duty to timely and properly investigate the claim against the insured was not relieved simply because it was waiting to receive information from the claimant’s attorney.” Id. at 1225.

In that situation, a policy limits offer would likely have been of little use to Yochim, as it would all have been consumed by a hospital lien. Yochim’s lawyer was obviously doing everything he could to delay any offer from Dairyland, so that he could argue that it came too late and permitted a bad faith claim that would open the policy limit. Had that possibility not been present, he would instead have been encouraged to promptly provide Dairyland the information necessary to obtain payment of the limits, and neither the stipulated judgment nor the bad faith action would have been necessary.

The law should not hold out incentives to create unnecessary litigation and subject insureds to unnecessary risk of excess judgments. The settlement duty can and should be shaped to protect policyholders and the judicial system, while providing more appropriate incentives to claimants.

One who hopes more for a breach of the settlement duty than for performance would prefer not to make demands, for a demand might be accepted and eliminate any possible recovery above limits. Such a party would prefer to wait for an offer, perhaps “signaling” supposed receptiveness. If the offer never comes, it can later be argued that a reasonable insurer would have made one and the injured party can then testify that it would have been accepted. If an offer below limits is rejected, there is still an ability to claim that a higher offer, still within limits, would have been accepted. Yet the claimant (who may not have decided what would be acceptable), retains the ability to reject any offer that is made.

The Texas Supreme Court has noted that there are good reasons why insurers are reluctant to make offers, especially in cases where the value is significantly arguable. Once the insurer makes an offer, it establishes a “floor” for negotiations and must stand by its offer or later risk excess liability for unreasonably withdrawing its offer. Am. Physicians Ins. Exch. v. Garcia, 876 S.W.2d 842, 851 n.18 (Tex. 1994). “Because the claimant bears little risk of losing the opportunity to settle … [for the amount offered], the claimant has no incentive to settle” when the offer is made; the claimant can look for assets of the tortfeasor or hope that some other development will improve the prospects of an above-limits recovery. Id. And if the insurer’s offer is below limits, the injured party can reasonably expect it to rise. Id.

Precisely to provide proper incentives to both parties, Texas holds that the settlement duty is triggered only by a demand from the claimant that the insurer ought to have accepted. Id. at 851. For the reasons just stated, that rule is better than the one requiring the insurer to initiate offers.

If a demand is required, it must be a firm demand: counsel’s opinion about what the claimant would or might accept is not enough. Comm’l Union Ins. Co. v. Mission Ins. Co., 835 F.2d 587, 588 (5th Cir. 1988) (La. law); see Cotton States Mut. Ins. Co. v. Phillips, 110 Ga. App. 581, 583 (1964) (insured’s letter expressing opinion that case could be settled within limits not enough). A demand subject to conditions that could not be satisfied cannot be the basis for bad faith liability, because acceptance of that demand could not have created a valid settlement. See Ins. Corp. of Am. v. Webster, 906 S.W.2d 77, 80–81 (Tex. Ct. App. 1995) (demands conditioned on lack of other insurance when an excess policy existed). But see Kelly v. State Farm Fire & Cas. Co., 169 So. 3d 328, 338 (La. 2015) (demand not required).

But a claimant’s informal statements that the claimant was only seeking the policy limits can constitute a demand. Gibbs v. State Farm Mut. Auto. Ins. Co., 544 F.2d 423, 427 (9th Cir. 1976) (Ca. law).

Even if an insurer is not required to initiate settlement negotiations, it may be obliged to respond to a demand with at least a counter offer. Baton v. Transamer. Ins. Co., 584 F.2d 907, 913–14 (9th Cir. 1978) (Or. law).

To provide the proper incentives to claimants, a firm demand whose acceptance could have settled the case should be a prerequisite for failure-to-settle liability unless the insured has obstructed the claimant’s consideration of possible demands or has breached some other duty to the insured.

***

William T. Barker is a member of the Insurance Litigation & Coverage Practice Group of Dentons US LLP, practicing in its Chicago office, with a nationwide practice, primarily representing insurers, in the area of complex insurance litigation, including coverage, claim practices, sales practices, risk classification and selection, agent relationships, and regulatory matters. He is the co-author, (with Ronald D. Kent) of NEW APPLEMAN INSURANCE BAD FAITH LITIGATION, SECOND EDITION and (with Prof. Charles Silver) of PROFESSIONAL RESPONSIBILITIES OF INSURANCE DEFENSE COUNSEL. He is an Adviser to the American Law Institute project on the RESTATEMENT THE LAW OF LIABILITY INSURANCE. He is a Vice Chair of the American Bar Association (“ABA”) Tort Trial & Insurance Practice Section Insurance Coverage Litigation Committee and a co-chair of the Subcommittee on Bad Faith Litigation of the ABA Litigation Section Insurance Coverage Litigation Committee. This article includes material adapted, with permission, from WILLIAM T. BARKER & RONALD D. KENT, NEW APPLEMAN INSURANCE BAD FAITH LITIGATION, SECOND EDITION. Copyright 2015 Matthew Bender & Company, Inc., a LexisNexis company. All rights reserved.”

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

Rule No. 1:

A CGL Policy Does Not Provide Coverage For “Bodily Injury” Or “Property Damage”

|

|

|

It is as common of a refrain as you’ll hear in a conversation about a commercial general liability policy – “A CGL policy provides coverage for damages for ‘bodily injury’ or ‘property damage.’” But does it really? After all, that’s not what ISO’s workhorse insuring agreement says. It states: “We will pay those sums that the insured becomes legally obligated to pay as damages because of ‘bodily injury’ or ‘property damage’….”

As ISO’s language shows, a CGL policy does not provide coverage for damages “for” “bodily injury” or “property damage” but, rather, damages “because of” “bodily injury” or “property damage.” There is a real difference. It seems like a day does not go by that I do not hear, or read, the mistaken use of “for” -- and not the correct “because of” -- when describing the nature of “bodily injury” or “property damage” coverage in a CGL policy. I’m counting myself here too. It’s an easy mistake to make and a hard habit to beak.

“Because of” is broader than “for.” In Ryan Companies US Inc. v. Everest National Insurance Co., No. 14-3207 (D. Minn. Feb. 2, 2016), the Minnesota District Court recently addressed how broad “because of,” when used in the CGL Insuring Agreement, is. It is an interesting case with relevance to construction defect coverage and, more generally, allocation of a settlement between covered and uncovered claims. Time does not allow for a discussion of this here. Hey, it’s Super Bowl Sunday as I write this. Kickoff is just seven hours away – which means I’ve already missed half the pre-game show to finish up this issue of CO. [There’s a limit to my commitment to this newsletter that you’re not paying for.]

So I’ll put Ryan Companies on my to-do list. I mentioned it here just to make the point about “for” versus “because of” as used in the CGL Insuring Agreement. Take note if you mistakenly use “for” when describing the nature of “bodily injury” or “property damage” coverage.

|

|

| |

|

|

|

|

Vol. 5, Iss. 2

February 10, 2016

“General Aggregate” Not Defined:

Supreme Court Says Insurer Obligated To Pay Its Limit--Twice

|

|

|

At the outset of Westchester Surplus Lines Inc. Co. v. Keller Transport, Inc., No. DA14-0278 (Mont. Jan. 12 2016), the Montana Supreme Court noted that the term “General Aggregate” was not defined in the policy before it. At that point, even knowing nothing about the story to come, I was pretty certain that it was not going to end well for the insurer. Courts intent on finding coverage, that otherwise should not exist, have a few ways to make this happen. One of them is to declare that, if the insurer meant for a policy term to have a certain meaning, then it could have, and should have, defined it as such. But since it didn’t, the court is left to grapple with two (or more) possible meanings of the term. And we all know what happens when courts find themselves so grappling. So, when the Keller Transport court made the point, right from the get-go, that the term “General Aggregate” was not defined in the policy, I put the insurer’s chances, for a happy ending, at about the same as an unknown character in Star Trek -- who finds himself in the landing party in the opening scene.

While the specific circumstances involved in Keller Transport do not happen every day, the court’s decision, that the undefined term “General Aggregate” is ambiguous, therefore requiring that it be paid twice, has widespread relevance.

At issue in Keller Transport was coverage for damages caused by an overturned tanker truck that spilled over 6,000 gallons of gasoline. The gasoline flowed under the highway and beneath several homeowners’ properties.

Keller Transport had leased the tanker truck from Wagner Enterprises. Keller and Wagner were insured under a primary policy that contained two coverage parts: Auto ($1 million Per Accident) and General Liability ($1 million Each Occurrence). The policy was subject to a $2 million General Aggregate. Keller and Wagner were insured under a follow form excess policy subject to a $4 million Occurrence limit and a $4 million General Aggregate.

In simple terms, following the spill, the primary policy paid $1 million for clean-up expenses and exhausted the Auto limit. The excess insurer paid $4 million and exhausted its limit. However, additional claims were made by homeowners, alleging that Keller and Wagner engaged in negligent conduct after the truck had overturned. These claims were alleged to trigger the General Liability coverage part of the primary policy. Thus, the homeowners sought an additional $5 million -- $1 million under the General Liability portion of the primary policy and $4 million under the excess policy. Never mind that the excess policy, with a $4 million General Aggregate, had already paid $4 million on account of the Auto claims.

Putting aside some other factors, and following a stipulated judgment and assignment of policy rights, the issue that made its way to the Supreme Court of Montana was whether the excess policy’s “General Aggregate” afforded $4 million for each type of coverage in the primary policy OR a $4 million limit for the entire excess policy.

The court held that the term “General Aggregate” was ambiguous, and, therefore, the excess insurer was obligated to provide an additional $4 million in CGL coverage. On one hand, the court went through a complex analysis to demonstrate that its decision was justified by the interplay between the primary and excess policies’ various limits, on account of the excess policy’s “follow-form” language: “the insurance afforded by this policy shall apply in like manner as the underlying insurance.”